Creating a Mobile Banking App: Trends, Target Audience, Features, and Development Process

Explore the world of mobile banking app development, from market trends and target audiences to development stages and technology stacks. Learn how to create a successful banking app with this comprehensive guide.

Mobile banking app market overview for 2021-2023

The mobile banking app market has been experiencing rapid growth and transformation over the past few years. With the rise of digital banking, financial institutions have recognized the importance of having a strong mobile presence to meet the demands of their customers. This growing trend is driven by evolving consumer behavior, as more people rely on their smartphones and other mobile devices for various banking needs.

In 2021, the global mobile banking market size was estimated to be worth around $1.17 trillion, and it is predicted to reach $2.33 trillion by 2023. The dynamic growth in the industry is a response to the increasing adoption of smartphones, advancements in network technologies, and the need for more accessible and convenient banking services. The widespread acceptance of mobile banking in both developed and developing markets is reshaping the financial services. Financial institutions are focusing on customer-centric strategies, like integrating more innovative features and incorporating the latest technological advancements, to provide seamless user experiences and stay ahead of the competition.

What can banking apps offer?

Banking apps have come a long way from just providing basic account details and transaction history. Modern banking apps now offer a wide range of features that cater to the diverse needs of their users. Some of the essential features most banking apps should offer include:

- Account management: Users can check their account balance, transaction history, and manage multiple accounts within the app

- Bill payments: Paying bills on time is crucial, and mobile banking apps make it easy for users to manage and schedule their bill payments effortlessly

- Fund transfers: Transferring funds between accounts or sending money to others is made easier through mobile banking apps

- Notifications and alerts: Users should be able to receive instant notifications for important account activities, such as deposits, withdrawals, or potential fraud alerts

- Biometric authentication: Ensuring secure access through fingerprint, facial recognition, or voice authentication enhances the app's security and user experience

- Transaction history: Access to a complete transaction history helps users track their spending, analyze patterns, and make informed financial decisions

- Financial planning: Some banking apps offer budgeting and financial planning tools to help users stay on track with their financial goals

- Customer support: Providing multiple support channels like live chat, phone, or email ensures that the users can get prompt assistance when needed

Trends of Mobile Banking

The evolution of mobile banking continues to be shaped by emerging trends and technological advancements. Here are some of the latest trends in mobile banking app development:

- Biometric Authentication: As security becomes a top priority in the financial world, biometric authentication methods like fingerprint, facial recognition, and voice recognition technologies are becoming more mainstream to ensure secure access to mobile banking apps

- Artificial Intelligence and Machine Learning: AI and machine learning technologies are being integrated into mobile banking apps to enhance user experiences, streamline transactions, and provide personalized financial management tools. Chatbots and virtual assistants are also gaining popularity to help users with common inquiries or account-related tasks

- Blockchain Technology: The adoption of distributed ledger technology, like blockchain technology, can enhance the security, transparency, and efficiency of mobile banking apps. Blockchain technology can help prevent fraud and reduce transaction costs, while ensuring a high level of security for all transactions

- Contactless Payments: The pandemic has accelerated the adoption of contactless payment methods like Apple Pay, Google Pay, and Samsung Pay. With Near Field Communication (NFC) technology, mobile banking apps can facilitate secure and convenient contactless transactions

- Personalized Banking: Mobile banking apps are harnessing the power of data analytics and AI to offer personalized services and financial management tools tailored to individual preferences and financial goals. This enables a more user-centric approach to banking services, improving engagement and user satisfaction

- API Integration: Open banking and API integration have opened doors to improved collaboration between FinTech and traditional banking ecosystems. Through API integration, mobile banking apps can offer streamlined services and access to third-party financial products directly within the app

Embracing these trends and implementing innovative technologies will help financial institutions stay competitive and adapt to the ever-changing landscape of mobile banking app development.

What is the target audience of mobile banking?

Understanding the target audience for mobile banking apps is crucial for banks and financial institutions to design and develop applications that cater to their audience's needs and preferences. The primary target audience for mobile banking apps tends to be individuals who are tech-savvy and comfortable using smartphones and mobile devices for managing their finances. This audience usually consists of:

- Millennials and Generation Z: Individuals belonging to these age groups tend to be early adopters of new technology and are more likely to manage their finances through mobile apps. They are comfortable with digital transactions and prefer quick and secure access to mobile banking services.

- Busy professionals: People with hectic schedules and limited time for visiting physical bank branches are more inclined to use mobile banking apps to manage their finances remotely.

- Small business owners: Entrepreneurs and small business owners benefit from mobile banking apps that offer financial management tools, allowing them to stay informed of their account activities and make important financial decisions on-the-go.

- Rural populations: Mobile banking apps can also cater to people living in remote and rural areas with limited access to traditional banking services. Mobile banking services can provide them with essential financial tools and allow them to participate in the modern financial ecosystem.

Understanding your target audience is crucial when developing a successful mobile banking app that addresses their needs and offers features and functionalities tailored to their preferences.

Mobile banking app features to have

When creating a mobile banking app, it is essential to include a set of robust features that cater to your target audience's needs and expectations. Some of the most important features to incorporate in a mobile banking app include:

- User-friendly interface: An intuitive and easy-to-navigate user interface is crucial for ensuring a positive user experience. A clear and straightforward layout with accessible menus will make it easier for users to access and use the app's features.

- Account management: Users should be able to view their account balance, transaction history, and account details, as well as easily manage multiple accounts if necessary.

- Bill payments and fund transfers: The app should support bill payments and fund transfers between accounts within the same bank or other banks, making it convenient for users to manage their finances.

- Notifications and alerts: Users should receive instant notifications and alerts for important account activities, such as low balance alerts, transaction confirmations, and due date reminders.

- Biometric authentication: To ensure the app's security, incorporating biometric authentication methods like fingerprint or facial recognition can provide an additional layer of protection for user accounts.

- Financial planning and management tools: Offering financial planning tools, such as budgeting, expense tracking, and goal setting, can help users manage their finances more effectively.

- Customer support: An in-app customer support system should be in place to assist users with any issues or account inquiries they might have. Incorporating these features into your mobile banking app will help create a user-friendly and functional app that satisfies the needs of your target audience.

Top Examples of Mobile Bank Applications

Several successful mobile banking apps serve as excellent examples of how to create a user-friendly and feature-rich application that effectively addresses customer needs. Some of the top mobile banking apps include:

- Chase Mobile: Chase Mobile, developed by JPMorgan Chase, is known for its user-friendly interface and comprehensive features, including account management, bill payments, mobile check deposits, and person-to-person payments.

- Bank of America Mobile Banking: The Bank of America app provides users with a well-designed interface and essential account management features, such as bill payments, fund transfers, mobile check deposits, and customized alert settings.

- Wells Fargo Mobile: Wells Fargo's mobile app allows users to manage their accounts, pay bills, transfer funds, and deposit checks. It also offers additional features like mobile wallet integration and financial planning tools.

- Citibank Mobile App: The Citibank app offers a range of digital banking services, including account management, bill payments, and fund transfers. The app also offers personalized insights and financial management tools to help users manage their finances effectively.

Banks and financial institutions can learn from these top mobile banking app examples and incorporate their successful features and approaches into their own app development process. By doing so, they can create a comprehensive and user-friendly mobile banking app that caters to their target audience's needs and preferences.

Types of Mobile Apps for Banks

There are three primary types of mobile apps for banks: native, cross-platform, and hybrid. Each type has its own advantages and development processes. Understanding the differences between them is crucial for making the right decision for your bank's mobile app strategy.

Native App Development

Native app development involves building separate applications for each platform, such as iOS and Android, using platform-specific programming languages, tools, and frameworks. Native apps provide an optimized user experience as they are designed specifically for the operating system they run on. For iOS app development, languages such as Swift or Objective-C and tools like Xcode are used. For Android app development, languages like Kotlin or Java and tools like Android Studio are used.

Pros:

- Optimized performance and user experience

- Full access to device features and capabilities

- Better security and stability

Cons:

- Longer development time and higher costs

- Separate codebases for each platform

Cross-Platform App Development

Cross-platform app development allows developers to write a single codebase that can run on multiple platforms. Popular cross-platform development frameworks such as React Native, Flutter, or Xamarin are used for creating these apps. While cross-platform apps may not offer the same level of performance and access to native device features as native apps, they significantly reduce development time and costs.

Pros:

- Single codebase for multiple platforms

- Faster development time and reduced costs

- Easier maintenance and updates

Cons:

- Potential performance and user experience compromises

- Limited access to some device features and capabilities

Hybrid App Development

Hybrid app development combines elements of both native and web applications. These apps are built using web technologies such as HTML, CSS, and JavaScript and are then wrapped in a native app shell using tools like Apache Cordova (formerly PhoneGap) or Ionic. Hybrid apps offer a cost-effective solution for banks that want to reach a wider audience without investing in separate native apps for each platform.

Pros:

- Single codebase for multiple platforms

- Faster development time and reduced costs

- Access to some native device features through plugins

Cons:

- Potential performance and user experience compromises

- Dependency on third-party plugins for native device features

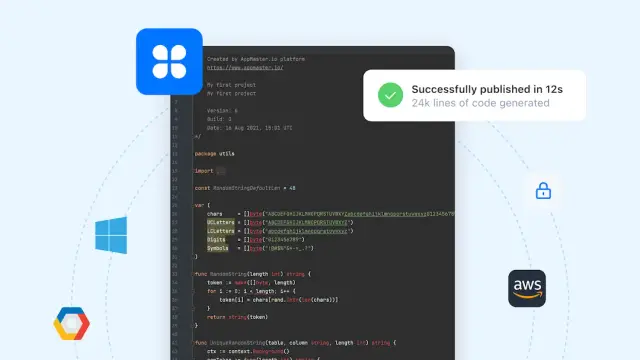

Considering your bank's target audience, goals, and resources will help you choose the best app development approach. To further streamline the development process, you may also consider adopting a no-code platform like AppMaster.io. AppMaster provides a number of powerful tools and features designed to simplify the creation of mobile banking apps, making it possible to create high-quality apps even without extensive programming experience.

Near Field Communication (NFC)

Near Field Communication (NFC) is a short-range wireless technology that enables contactless transactions between an NFC-enabled smartphone and an NFC-enabled terminal. It has gained widespread popularity in recent years due to its speed, convenience, and security. NFC plays a crucial role in the world of mobile banking as it enables users to make contactless payments in stores, transfer funds between devices, and even receive essential information from smart posters.

Advantages of NFC in mobile banking:

- Convenience: Contactless transactions with NFC are swift and hassle-free, with no need for physical contact with the terminal.

- Security: NFC transactions are encrypted and secure. Additionally, mobile banking apps often implement measures like biometric authentication or PIN numbers to further protect users' information.

- Versatility: Besides payments, NFC technology can also be used for various purposes like peer-to-peer transactions, digital business cards, and smart posters.

Many banks have already started integrating NFC technology into their mobile apps to allow for secure and straightforward mobile payments. Ensuring that your mobile banking app supports NFC can provide a significant competitive advantage in today's increasingly digital financial industry.

Digital wallets

Another critical aspect of mobile banking is the integration of digital wallets in mobile banking apps. Digital wallets – also known as e-wallets – store users' payment information securely, enabling them to make swift and convenient online and contactless transactions. Digital wallets have become increasingly popular, with many people opting to use them instead of traditional payment methods like credit cards, cash, or checks.

Key features of digital wallets for mobile banking apps:

- Secure storage of payment information: Digital wallets store users' credit card, debit card, and bank account details securely, allowing them to make transactions without needing to input sensitive information each time.

- Contactless payments: Digital wallets can enable contactless payments using NFC technology, allowing for fast and secure in-store transactions.

- Online shopping: Many digital wallets also integrate with popular e-commerce platforms, making the online shopping experience quicker and smoother.

- Peer-to-peer transfers: Digital wallets often support peer-to-peer transactions, allowing users to easily send and receive money from friends or family members.

- Loyalty programs and rewards: Integration of loyalty programs and rewards from various retailers in digital wallets helps users keep track of their points or offers and redeem them seamlessly.

By incorporating digital wallets into your mobile banking app, you can offer users convenient, secure, and efficient ways to manage and access their finances. Ensuring that your mobile banking app includes essential digital wallet features and capabilities can help position your bank as a leader in the evolving fintech sector.

Quick Reply (QR)

QR (Quick Response) codes have become a popular tool in mobile banking apps to facilitate convenient and secure transactions. QR codes are two-dimensional barcodes that can store a variety of data, making them a versatile method for transferring information between two parties. Here are some of the ways QR codes are used in mobile banking applications:

- Payments: QR codes facilitate an easy and contactless way for users to make payments at participating merchants. Users simply need to scan the merchant's QR code using their banking app to make an instant payment. This eliminates the need for physical cards or cash and offers a fast and secure transaction process.

- Peer-to-peer transfers: Mobile banking apps can generate personalized QR codes that represent a user's account. When another user scans this code, they can easily initiate a funds transfer to the designated account. This method simplifies the process of exchanging account details for peer-to-peer transactions.

- Bill payments: In some cases, utility providers or other billers may include a QR code on their invoices. Scanning this QR code with a mobile banking app can automatically populate the relevant payment details, saving users time by not having to manually input information. Incorporating QR code functionality within a mobile banking app can significantly improve user experience and streamline transactions across multiple use cases. Developers should ensure that they integrate secure methods of data storage and encryption when implementing QR code features to maintain a high level of security during transactions.

Internet payments

Internet payments or online transactions are an essential aspect of modern banking apps, allowing customers to pay for goods, services, and utility bills through a secure online platform. Integrating internet payment features in your mobile banking app is key for providing convenience to your users. Here are some essential components of internet payments functionality:

- Secure payment gateway integration: It is crucial to integrate a secure and reliable payment gateway to process online payments. This should ensure the user's sensitive banking credentials and personal information remain protected.

- Multi-factor authentication: To enhance app security, implementing multi-factor authentication (MFA) during online transactions can help protect your user's accounts from unauthorized access. Methods like OTPs (one-time passwords), biometric authentication, and security questions add an extra layer of security to online payments.

- Card management: Users should be able to manage and save multiple debit/credit card details securely to avoid manually entering card information for each transaction. This data should be encrypted and stored securely. -

- E-commerce integrations: Mobile banking apps can also partner with e-commerce platforms or other service providers to facilitate seamless in-app transactions. This allows users to make purchases directly from within the app, offering a unified and streamlined user experience. Building these features into your mobile banking app will ensure that your users have access to secure and efficient internet payment methods, enhancing their overall banking experiences.

Mobile transaction management

Effective mobile transaction management is essential for helping users monitor and control their expenditures, saving them time and effort. Mobile banking apps should provide a comprehensive suite of transaction management tools including:

- Transaction history: The app should offer a detailed account transaction history, allowing users to view, sort, and filter their transaction records. This can include both completed and pending transactions.

- Alerts and notifications: Users should receive real-time notifications for important account activities, such as transactions made, low account balance warnings, and suspicious transaction alerts. Customizable notifications can further enhance the user experience and ensure they always stay informed.

- Spending analysis: Providing users with tools to categorize and analyze their spending habits can help them better manage their finances. Mobile banking apps can integrate features such as automatic expense categorization, budget tracking, and personalized insights to support financial planning.

- Transaction search and dispute reporting: Users should be able to search their transaction history using keywords or filter by date, amount, or transaction category. In addition, a user-friendly dispute resolution process should be in place to report issues with transactions directly within the app. Implementing these mobile transaction management features will greatly benefit users by giving them full control and insight into their financial activities - all through a single banking app.

Creating a mobile banking app involves understanding users' needs and adopting cutting-edge technologies to provide fast, secure, and convenient financial services. Integrating QR code functionality, secure internet payment options, and mobile transaction management tools will enhance your app's value proposition, paving the way for a feature-rich and user-friendly banking experience. If you are considering building a mobile banking app with minimal time and effort, consider leveraging a powerful no-code platform like AppMaster to streamline the development process seamlessly.

A step-by-step guide on mobile banking development

Developing a mobile banking app involves a systematic approach that ensures its success in the competitive fintech market. This section provides a step-by-step guide to building a mobile banking app, starting with research and planning and progressing through prototype validation.

Conduct research and make a plan

The initial phase of mobile banking app development is centered around research and planning. This is a crucial stage that ensures you have a comprehensive understanding of your target market, competitors, and desired features for your app. Here are the main steps to follow:

- Market research: Before starting development, it's essential to understand the market landscape for mobile banking apps. Gather data on popular features, user preferences, and customer needs to identify the gaps in the existing market and create a unique value proposition.

- Competitor analysis: Evaluate the strengths and weaknesses of your potential competitors' mobile banking apps. Examine what features and functionalities they offer, the design quality, and their security mechanisms. Learning from their successes and failures will help you build a better app.

- Target audience: Identify your primary target audience and develop user personas to understand their preferences and needs better. This will help you tailor your app's features, design, and functionality to be more appealing to your target users.

- Define the app's core features: Based on your research, make a list of the core features you want to include in your mobile banking app. Prioritize features that address the most pressing needs of your target audience and set your app apart from competitors.

- Develop a project roadmap: Create a detailed project roadmap outlining the stages of development, key milestones, and deadlines. This will help your development team stay on track and ensure that your project is delivered on time and within budget.

Build and verify a prototype

Once you have completed the initial research and planning phase, it's time to build a prototype of your mobile banking app. A prototype will help validate your ideas and concepts, as well as gather early feedback from potential users.

- Wireframing: Start by creating wireframes of the app's user interface (UI). Wireframes are simple, functional representations of your app's design, showcasing the layout, navigation, and overall structure. Wireframing will help you visualize your app's structure and ensure you have a clear understanding of how it will look and function. You can use tools like Adobe XD, Sketch, or Figma to create wireframes.

- Prototyping: Develop a clickable prototype of your app based on the wireframes. This will help you see how the app will function, identify any usability issues and gather feedback from potential users. There are various prototyping tools available, including InVision, Marvel, and Axure RP, which can assist you in this process.

- User testing: Conduct user testing sessions with your target audience to gather feedback on your prototype. This will help you identify any areas of improvement and ensure that your app meets user expectations. Carefully consider feedback and make the necessary adjustments to your app's design and features.

- Refine and iterate: Based on the feedback from user testing, refine your prototype to address any issues or add new features. Repeatedly iterate and test your prototype to ensure that you create a user-friendly and efficient mobile banking app.

At the end of this stage, you should have a validated prototype of your mobile banking app, ready for the next phase: laying the groundwork for security and foundation-level architecture.

Lay the Groundwork for Security

Security is a top priority when developing a mobile banking app, as it deals with sensitive financial information and transactions. Ensuring the highest level of security from the start minimizes the risk of data breaches and other cybersecurity threats. Here are some essential steps to lay the groundwork for a secure banking app:

- Encryption: Encrypt sensitive data both in transit and at rest to protect it from unauthorized access. Secure Socket Layer (SSL) and Transport Layer Security (TLS) protocols can be used for data encryption during communication between the client-side app and the server-side application.

- Secure User Authentication: Implement strong user authentication methods like multi-factor authentication (MFA), biometric authentication, and One-Time Passwords (OTP) to ensure secure access to users' accounts.

- Secure API Communication: Implement secure APIs communication by adopting API security best practices, such as using OAuth 2.0 for authentication, HTTPS for communication, and rate limiting to prevent abuse of the API.

- Code Obfuscation: Obfuscate the app's source code to make it harder for hackers to reverse-engineer and exploit vulnerabilities in your application. Code obfuscation tools can mask the structure and logic of the code, making it difficult for attackers to decipher.

- Secure Storage: Safeguard sensitive user data stored within the app. Use encrypted databases or secure key storage solutions, such as the iOS Keychain or Android Keystore, to securely store sensitive data on the device.

- Regular Security Testing: Perform periodic security testing, including penetration testing, vulnerability scanning, and static and dynamic code analysis, to identify and remediate potential security risks.

Design the UI and UX

Creating an intuitive and user-friendly mobile banking app is vital to encourage user adoption and provide a seamless experience. To ensure an engaging and functional UI/UX design, follow these steps:

- Understand User Needs: Conduct user research to understand their preferences, requirements, and behavior. Utilize this data to inform your design choices and create a solution that caters to users' needs effectively.

- Create User Flow and Wireframes: Build a clear and logical user flow that outlines the steps involved in completing key tasks within the app. Then, create wireframes that visualize the user flow to ensure the organization and layout of the app are intuitive and easy to navigate.

- Design High-Fidelity Mockups: Develop high-fidelity mockups that incorporate your chosen color schemes, fonts, icons, and other visual elements to establish a consistent and appealing design for your mobile banking app.

- Iterate and Optimize: Monitor user feedback and analytics to iterate and optimize your UI/UX design as needed. Continuously adapting your design based on real-world user data can significantly improve usability and user satisfaction.

- Accessibility: Ensure that the app is accessible to users with disabilities, following accessibility guidelines like the Web Content Accessibility Guidelines (WCAG), to create an inclusive user experience.

Choose a Technology Stack

Selecting the right technology stack for your mobile banking app is essential to achieve performance, security, and user experience goals. There are several options available, such as native app development, cross-platform app development, and hybrid app development. To determine the most suitable technology stack for your mobile banking app, consider the following factors:

- Project Goals and Requirements: Identify your app's goals and requirements, such as specific features, performance expectations, budget, and timelines. These factors will influence your choice of technology for the project.

- Target Platforms: Determine which platforms (iOS, Android, or both) you want your app to be available on. This decision significantly impacts your technology stack, as some tools and frameworks are platform-specific, while others support multiple platforms.

- Team Expertise: Evaluate your development team's skills and expertise regarding various programming languages, tools, and frameworks. Choose a technology stack that aligns with your team's strengths and abilities to ensure a smooth development process.

- App Maintenance and Updates: Consider the ease of maintaining and updating your app using the chosen technology stack. An easily maintainable and updatable app can save time, effort, and resources in the long run.

Platforms like AppMaster.io's no-code platform offer powerful tools for creating secure, user-friendly, and high-performing mobile banking apps with minimal coding requirements. Such platforms can significantly accelerate the development process and reduce the overall complexity of building a mobile banking app.

Code the app

Coding your mobile banking app is a crucial step in the development process. During this stage, you will bring your design and feature requirements to life by programming the app's functionalities. It's essential that you have a well-structured codebase to ensure easy maintenance and updates in the future.

- Follow best coding practices: Maintain a clean and organized codebase by adhering to industry-specific coding standards and best practices. This will not only make your development process more efficient but also help you ensure that your app is scalable and maintainable in the future.

- Use version control: Leverage version control tools such as Git to track changes in your codebase and collaborate effectively among team members. This will help you avoid code conflicts and make it easier to review changes and roll back to previous versions, if needed.

- Implement security measures: As a mobile banking app, security should be a top priority. Make sure to apply proper encryption for sensitive data, use secure connections for data transmission, and implement measures to prevent unauthorized access, such as biometric authentication.

- Perform unit testing: Write and execute unit tests for individual components of your app to ensure that each part functions as expected. This will help you identify and fix bugs early in the development process, reducing the likelihood of major issues in the later stages.

- Consider using AppMaster platform: To expedite the development process without compromising on quality, consider using the AppMaster platform. AppMaster offers a no-code solution that generates source code for mobile and backend applications, simplifying mobile banking app development and making it more accessible.

Integrate with third-party solutions

In order to provide a seamless user experience, your mobile banking app will need to integrate with various third-party solutions, such as payment gateways, SMS gateways, and external APIs for added functionalities (like analytics, push notifications, etc.).

- Choose the right solutions: Prioritize choosing reliable and secure third-party solutions that align well with your app's requirements and target audience.

- API integration: Connect to the necessary APIs provided by third-party solutions for smooth integration. Follow the API documentation and use appropriate SDKs or libraries to facilitate easier integration.

- Test the integrations: Thoroughly test each integration to ensure that data exchange works correctly, and the app delivers the expected user experience. Watch out for any possible bottlenecks or issues that may arise during integration to address them promptly.

- Establish a support system: Ensure that you have adequate documentation and support from third-party solution providers to resolve integration-related issues in a timely manner.

- Monitor performance: After integrating your app with third-party solutions, keep an eye on their performance, stability, and security. This will help you ensure that external integrations do not adversely affect the overall quality of your mobile banking app.

Release and maintain

The final stage of mobile banking app development involves releasing the finished product and maintaining it to ensure a consistent and reliable user experience.

- Alpha and beta testing: Prior to releasing your app, conduct alpha and beta testing to gather valuable user feedback and identify any bugs or issues that need to be addressed. This will help you refine your app and ensure a smooth experience for users upon launch.

- App store submission: Prepare your app for submission to the desired app stores ( Apple App Store and Google Play Store). Submit your app along with the necessary assets, metadata, and guidelines set by the respective stores.

- Maintaining the app: Regularly update and maintain your mobile banking app to stay competitive in the market. Address user feedback, fix bugs, ensure security patches are applied, and implement enhancements to keep your app relevant and user-friendly.

- Monitor app performance: Track your app's performance through analytics and user feedback. Keep an eye on key performance indicators (KPIs), such as user acquisition, retention, and churn rates. Use this data to make data-driven decisions for app improvements and future updates.

- Continuous improvement: Stay up-to-date with the latest trends, technologies, and user demands in the mobile banking app space. Use this knowledge to continuously adapt, modify, and improve your app's features and functionalities to provide a top-notch banking experience to your users.

Developing, releasing, and maintaining a mobile banking app is a multi-step process that requires thorough planning and execution. By following the best practices outlined in this article and making use of platforms like AppMaster, you can successfully launch a secure and user-friendly mobile banking app that meets the growing expectations of modern banking customers.

Market your app and get feedback

Once you have developed and launched your mobile banking app, it's crucial to promote it in order to reach your target audience and drive user adoption. Here are some steps you can follow to market your app effectively:

- App Store Optimization (ASO): Ensure your app listing is optimized for both Google Play Store and Apple App Store, leveraging keywords, descriptive titles, and compelling app descriptions to attract potential users.

- Build a website: Create a dedicated website or landing page showcasing your mobile banking app's features, benefits, and call-to-action for users to download the app.

- Social media marketing: Leverage social media platforms to engage with potential users by sharing updates, promotional content, and success stories related to your mobile banking app.

- Public relations: Reach out to journalists, influencers, and thought leaders in the fintech industry and share your app's unique features and functionalities to get coverage and generate buzz.

- Content marketing: Produce and distribute valuable content such as blog posts, infographics, videos, and more to promote your mobile banking app and educate your target audience on its benefits.

- Email marketing: Utilize email marketing campaigns to communicate with existing customers and prospects, showcasing the key features and advantages of your mobile banking app.

- Ad campaigns: Run targeted ad campaigns on platforms such as Google Ads, Facebook Ads, or LinkedIn Ads to reach a broader audience and drive downloads. To continue refining and enhancing your mobile banking app, it's essential to gather feedback from your users. You can collect feedback through in-app surveys, app store reviews, or focus groups. Analyzing this feedback will provide you with valuable insights into your app's strengths and weaknesses, allowing you to make data-driven decisions for future improvements.

Improve and update

Continuous improvement is critical in the rapidly-evolving fintech landscape. Regularly updating your app ensures that you maintain a competitive edge and deliver a superior user experience. To improve and update your mobile banking app, consider these steps:

- Monitor performance metrics: Track key performance indicators (KPIs) such as app downloads, user engagement, retention rate, and customer feedback. This data will help you identify areas for improvement.

- Address user feedback: Pay attention to reviews, suggestions, and complaints from your app users to identify their needs and issues that need fixing.

- Update security measures: As a banking app, security must be a top priority. Regularly review and update your app's security measures to protect users and maintain trust.

- Enhance existing features: Continually improve the user experience of your app by refining its features based on user behavior and feedback.

- Add new features: Introduce new functionalities to cater to the evolving needs of your users, such as integrating AI-powered financial advisory tools, biometric authentication, or voice-enabled transactions.

- Stay abreast of industry trends: Keep up with the latest developments in mobile banking technology and incorporate relevant innovations into your app to remain competitive.

- Optimize the app for new devices: Ensure compatibility with an expanding range of mobile devices and operating systems to deliver a seamless user experience. Remember that improvement is an ongoing process that requires rigorous monitoring and updates to ensure an exceptional mobile banking experience for your users.

Best technology stack for mobile banking app development

Choosing the right technology stack for your mobile banking app development will significantly impact the app's performance, scalability, and overall user experience. Below, we discuss three popular approaches to mobile app development and their advantages:

Native app development

Native app development involves creating apps tailored to specific mobile operating systems (e.g., Android or iOS) using their respective programming languages, such as Java or Kotlin for Android and Swift or Objective-C for iOS. This approach offers excellent performance, seamless OS integration, and robust security. Pros:

- Superior performance and user experience

- Full access to device features and APIs

- Strict adherence to platform-specific guidelines

- Strong security measures

Cons:

- Higher development cost and time

- Requires separate codebases for each platform

Cross-platform app development

Cross-platform app development involves using a single codebase to create apps that work on multiple operating systems. Popular cross-platform development frameworks include React Native, Xamarin, and Flutter. This approach is cost-effective and enables faster time-to-market. Pros:

- Single codebase for multiple platforms

- Lower development cost and time

- Easier to maintain and update

Cons:

- Potential performance limitations

- Restricted access to native device features

Hybrid app development

Hybrid app development involves creating web applications wrapped in a native container, primarily using HTML, CSS, and JavaScript. This approach leverages web technologies while offering the functionality and feel of native apps. Common hybrid app development frameworks include Ionic, Cordova, and PhoneGap. Pros:

- Single codebase for web and mobile platforms

- Lower development cost

- Reduced time-to-market

Cons:

- Compromised performance compared to native apps

- Limited access to some native device features

Ultimately, the best technology stack for your mobile banking app depends on your app's specific requirements, target audience, available resources, and strategic goals. Additionally, you can accelerate the development process and minimize technical debt by leveraging no-code platforms like AppMaster, which helps in creating fully-interactive, easily maintainable banking apps with robust security features.

Native app development

Native app development is the process of creating mobile banking applications that are developed and optimized specifically for the target operating system – such as Android or iOS. These applications are coded in languages that are native to the platform: Java or Kotlin for Android and Objective-C or Swift for iOS. Choosing the native app development approach has several benefits:

- Performance: Native apps are generally faster and more efficient than cross-platform or hybrid apps. They can tap into the resources and capabilities of the devices they run on, which also makes them more responsive.

- Integration: Native apps can seamlessly integrate with device-specific features, such as location services, camera, and push notifications. They also offer greater compatibility with third-party software and hardware that run on the same platform.

- App store compliance: Native apps are more likely to meet the specific design and usability guidelines of app stores, making it easier to gain acceptance and reach a larger audience.

- User experience: Building a banking app that looks and feels like other native apps on the user's device ensures a consistent user experience. Native apps can also include platform-specific UI elements, animations, and navigation.

However, native app development also comes with certain drawbacks:

- Development time and cost: Developing and maintaining two separate codebases (one for Android and another for iOS) can increase the development time and cost. It may also require hiring specialists with expertise in the respective programming languages.

- Duplicated work: The need to develop different versions of the banking app for each platform leads to duplicated effort and potential inconsistencies between app versions.

Given the security demands of a banking app, native app development is often the preferred choice, especially if performance, seamless integration, and adhering to platform guidelines are more critical than development cost and time.

Cross-platform app development

Cross-platform app development involves creating a mobile banking app that can be run on multiple operating systems (like Android and iOS) using a single codebase. The primary advantage of this approach is that it reduces development time and cost. Some popular cross-platform development frameworks include React Native, Xamarin, and Flutter. Benefits of creating a cross-platform mobile banking app include:

- Shared codebase: With cross-platform development, you maintain a single codebase, reducing the time and resources required to develop and update the app.

- Lower cost: By reusing code and components across different platforms, developers can reduce the overall development cost. Additionally, the demand for multiple platform-specific developers is minimized, further reducing the cost.

- Faster time-to-market: Building a mobile banking app for multiple platforms simultaneously can accelerate the time-to-market, making your app available to a wider audience more quickly.

The main drawbacks to cross-platform app development are:

- Performance: Cross-platform apps may not offer the same level of performance as native apps. They often have slower loading times and may not feel as snappy as their native counterparts.

- Device-specific integration: While cross-platform frameworks do offer some integration with device features, they might not support all device capabilities or platforms as effectively as native app development.

- User experience: Since cross-platform apps are designed to work across multiple platforms, they might not deliver a platform-specific UI or UX. This can affect app quality and customer perception.

While cross-platform app development can save time and money, it might not be the best choice for building a mobile banking app if performance, tight integration, and exceptional user experience are deemed more important.

Hybrid app development

Hybrid app development is an approach where a mobile banking app is built as a web application (using HTML, CSS, and JavaScript) and then wrapped in a native container to run on mobile devices. Tools like Apache Cordova (previously known as PhoneGap) and Ionic are commonly used for hybrid app development. Advantages of hybrid app development include:

- Code reusability: Like cross-platform development, hybrid app development uses a single codebase for the web app, which is then converted to run on multiple platforms. This approach simplifies updates and minimizes duplication of efforts.

- Lower cost: Since hybrid apps are developed as web apps, developers with web development skills can handle the entire project, reducing the need for multiple platform-specific developers.

- Flexibility: Hybrid app development allows you to build a mobile app using familiar web technologies (HTML, CSS, JavaScript).

Disadvantages of hybrid app development are:

- Performance: As with cross-platform apps, hybrid apps often perform slower than native apps. This performance gap can become noticeable as the app grows in complexity, potentially impacting user satisfaction.

- Integration and user experience: Since hybrid apps use a web-driven approach, they may not provide the same level of seamless integration and native-like user experience as native apps.

When it comes to choosing the best development method for a mobile banking app, consider the app's requirements, target audience, and the available resources. While native app development provides the best performance and user experience, cross-platform and hybrid approaches can save time and cost but may come with compromises in performance and integration.

How much does it cost to develop a mobile banking app?

Estimating the cost of developing a mobile banking app is a complex process that depends on multiple factors such as the app's features, the development method, the development team's location and expertise, and project management expenses.

App Features and Complexity

The cost of a mobile banking app is determined by its features and complexity. A basic app with limited features will be less expensive to develop compared to a full-fledged app with a wide range of options and functionalities. Basic apps might include standard features such as user authentication, account management, and simple transactions. In contrast, a more advanced app may include advanced features such as real-time notifications, biometric authentication, predictive analytics, and integration with third-party systems.

Development Method

The chosen development method significantly impacts the cost of creating a mobile banking app. There are three main development methods:

Native app development: Apps built specifically for a particular platform (Android or iOS) using native languages like Kotlin for Android, and Swift or Objective-C for iOS. Native apps typically offer better performance and a more seamless user experience, but this approach requires separate codebases for each platform, which increases development costs and time.

Cross-platform app development: Apps built using frameworks like React Native or Flutter that allow developers to create a single codebase that works on multiple platforms. While cross-platform development can save time and money, the resulting app may not perform as well as a native app.

Hybrid app development: Apps built using web technologies like HTML, CSS, and JavaScript, wrapped in a native container for deployment on various platforms. Hybrid apps are generally easier and cheaper to develop but could be limited in terms of performance and platform-specific features.

Development Team's Location and Expertise

The development team's location and hourly rates can significantly impact the cost of developing a mobile banking app. Rates vary across different regions, with developers in countries like the United States, Australia, and Western Europe charging higher rates compared to those from Eastern Europe, Asia, or Latin America. Apart from the location, the expertise and experience of the development team will also contribute to the overall app development costs.

Project Management Expenses

The mobile banking app development process involves more than just coding - project management, quality assurance, and design also incur expenses. Be prepared to account for these additional costs when estimating the app's development budget. Considering all these factors, the cost of developing a mobile banking app can range from a few thousand dollars for a basic app built using hybrid or cross-platform technology, to several hundred thousand dollars for a feature-rich native application developed by a team with extensive experience in the fintech sector. However, the final cost will ultimately depend on your specific requirements, production timeline, and available resources. To minimize costs while maintaining high-quality standards, consider partnering with an experienced no-code platform like AppMaster, which can streamline the mobile banking app development process and reduce time-to-market.

FAQ

Recent trends in mobile banking app development include the adoption of innovative technology such as biometric authentication, artificial intelligence, and machine learning to enhance user experiences, streamline transactions, and provide personalized financial management tools.

Key features of a mobile banking app include a user-friendly interface, account management, bill payments, fund transfers, notifications and alerts, biometric authentication, transaction history, financial planning, and customer support.

Mobile apps for banks come in various forms such as native apps, cross-platform apps, and hybrid apps. Each type has its own advantages and development processes, depending on the bank's target audience, goals, and resources.

Near Field Communication (NFC) enables contactless payments through a mobile banking app by allowing users to simply tap their smartphones on NFC-enabled terminals. This technology offers a secure and convenient way of making in-store purchases and peer-to-peer transactions.

The development process of a mobile banking app includes conducting research and making a plan, building and verifying a prototype, laying the groundwork for security, designing the UI and UX, choosing a technology stack, coding the app, integrating with third-party solutions, releasing and maintaining the app, marketing the app and getting feedback, and continuously improving and updating the app.

The cost of developing a mobile banking app can vary greatly depending on factors such as the app's features and functionalities, the chosen development method (native, cross-platform, or hybrid), and the location of the development team. Costs can range from a few thousand dollars to several hundred thousand dollars.