How to Create a Mobile Wallet App like Google Pay or Apple Wallet?

Learn how to design and develop a mobile wallet application similar to Google Pay or Apple Wallet, from feature ideas to security protocols and implementation options. Discover how no-code platforms like AppMaster can simplify the process.

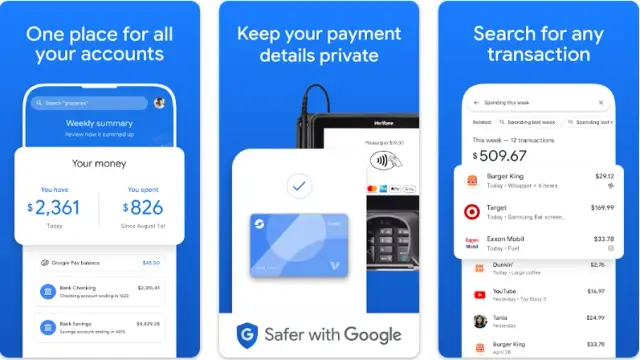

In today's dynamic digital environment, mobile wallet apps have revolutionized the way we handle transactions, manage finances, and conduct everyday payments. Industry leaders like Google Pay and Apple Wallet have set the bar high, necessitating a deep understanding of software development principles, stringent security measures, and a focus on exceptional user experience. This article delves into the key considerations and essential steps involved in creating a mobile wallet app that rivals the giants.

Choosing the Right Technology Stack

Creating a mobile wallet app like Google Pay or Apple Wallet requires a strong and reliable technology stack. Choosing the right set of technologies is crucial for building the best user experience and ensuring the scalability of your application. The technology stack consists of programming languages, frameworks, platforms, and other technical tools needed to develop the application. The technology stack for a mobile wallet app can be divided into three categories:

Backend

The backend is the server-side component responsible for processing transactions, managing user profiles, and storing data. The proper selection of backend technologies can influence scalability, performance, and security.

- Programming languages: Choose a language that is fast, secure, and reliable, like Python, Java, or Go (Golang).

- Frameworks: Use frameworks like Django, Express, or Flask to speed up backend development.

- Databases: Choose a scalable and performant database like PostgreSQL, Amazon Aurora, or MySQL.

Frontend

The frontend is the client-side component responsible for displaying information and managing user interaction. Ensure your frontend is user-friendly, responsive, and has seamless navigation.

- Mobile development platforms: Android and iOS platforms are the dominant players in the market. Use native technologies such as Kotlin for Android and Swift for iOS, or cross-platform technologies like React Native, which allow you to use a single codebase across multiple platforms.

- UI/UX Design Tools: Use tools like Sketch, Adobe XD, or Figma for designing the application's user interface.

DevOps and Deployment

The tools and practices for deploying and managing your application should be reliable, scalable, and secure.

- Deployment platforms: Use platforms like AWS, Azure, or Google Cloud for fast and cost-effective app deployment.

- Containerization: Utilize Docker or Kubernetes for containerizing your application and improving deployment efficiency.

Leveraging No-Code Platforms: AppMaster

Developing applications with traditional coding methods can be time-consuming and expensive. No-code platforms offer an innovative way to speed up the development process while maintaining reliability and scalability. One such platform is AppMaster. AppMaster is a powerful no-code tool that allows you to create backend, web, and mobile applications without writing code. It offers the following benefits for developing mobile wallet applications:

- Visual Development: With AppMaster, you can design user interfaces, database schemas, and business logic using drag-and-drop visual tools. It simplifies the design process and reduces time spent on coding.

- Auto-Generated Source Code: AppMaster generates source code for your applications in Go (Golang) for the backend, Vue3 framework with JS/TS for web applications, and Kotlin and Jetpack Compose for Android and SwiftUI for iOS. It allows companies of all sizes to develop scalable and maintainable applications easily.

- Secure and Scalable: AppMaster applications are generated from scratch every time, eliminating technical debt. They can work with any PostgreSQL-compatible database as the primary database and demonstrate amazing scalability for the enterprise and high-load use cases.

- Diverse Subscription Options: AppMaster offers different subscriptions, ranging from free plans for learning and exploring the platform, to more advanced options with additional resources and full access to generated source code.

By leveraging the power of AppMaster, you can create a mobile wallet app similar to Google Pay or Apple Wallet with more efficiency, reduced costs, and better scalability.

Integrating Third-Party Services

Mobile wallet apps require integration with third-party services to facilitate a seamless user experience. Some integrations you should consider when building your mobile wallet app include:

- Payment gateways and banking APIs: To enable secure and seamless transactions, integrate your app with reliable payment gateways like Stripe, Square, or Braintree. Connect your application with popular banking APIs to allow users to link their bank accounts and cards.

- Card-issuing partners: Partner with card-issuing agencies like Visa, Mastercard, and American Express to enable support for a wide range of credit and debit cards.

- Device manufacturers' wallet APIs: Integrate your app with device manufacturers' wallet APIs, such as Apple Pay APIs on the iPhone, or Google Pay APIs on Android devices. Integrations with device wallets will make it easier for users to access and use your application.

- Location services: Equip your app with location services to allow users to find nearby merchants or ATMs that accept mobile payments.

- Email or SMS services: Offer secure, real-time, and transactional notifications by integrating email or SMS services like Twilio or SendGrid.

Integrating these third-party services will improve the functionality and user experience of your mobile wallet app, resulting in higher customer satisfaction and a stronger competitive edge.

Compliance and Regulatory Guidelines

When developing a mobile wallet app like Google Pay or Apple Wallet, complying with the necessary regulations and guidelines is crucial to ensure a secure and trustworthy experience for your users. Here are the primary compliance and regulatory aspects you need to consider when creating a mobile wallet app:

Payment Card Industry Data Security Standard (PCI DSS)

PCI DSS is a global set of security standards designed to ensure that all businesses that accept, process, store, or transmit credit card information maintain a secure environment. To create a mobile wallet app that processes card payments, you must ensure that your app complies with the latest PCI DSS requirements, which includes implementing data encryption, protecting stored cardholder data, and ensuring secure communication channels. You should also work with third-party payment gateways and banks that are PCI DSS compliant.

Know Your Customer (KYC) and Anti-Money Laundering (AML)

KYC and AML regulations aim to prevent illegal activities like identity theft, financial fraud, and money laundering. These regulatory requirements may vary depending on your target market, but generally involve verifying the identity of your users and monitoring their transactions to detect suspicious activity. When creating a mobile wallet app, ensure you have proper measures in place for user identification, such as collecting identification documents, verifying addresses, and taking steps to confirm the authenticity of the provided information. Partnering with identity verification services can help you streamline the process.

Data Privacy Regulations

Mobile wallet apps process and store sensitive information, which makes adhering to data privacy regulations, such as General Data Protection Regulation (GDPR) in the European Union or California Consumer Privacy Act (CCPA) in the United States, extremely important. To ensure compliance, you should implement data protection measures, such as encryption, limiting data access to authorized personnel, and allowing users to control their data. Additionally, take into account any local data privacy regulations in the markets where you plan to launch your mobile wallet app.

Launching and Promoting Your Mobile Wallet App

After developing your mobile wallet app and ensuring compliance with all the necessary regulations, you're ready to launch. Here are some steps to help launch and promote your app effectively:

- Develop a Marketing Strategy: Determine your target audience, research competitors, define your value proposition, and set marketing objectives. Outline your marketing plan, including the budget, channels, messaging, and key performance indicators (KPIs).

- Soft Launch: Release your mobile wallet app to a limited audience in a specific market to gather user feedback, identify potential issues, and optimize the app's performance before going for a full-scale launch.

- Gather and Implement User Feedback: Actively collect user feedback through surveys, in-app reviews, and social media platforms. Use this feedback to improve your app and provide a better user experience.

- App Store Optimization (ASO): Optimize your app store listing with relevant keywords, engaging visuals, and clear descriptions to increase visibility and attract more users.

- Social Media and Content Marketing: Leverage social media channels to engage with potential users, share updates, and promote your app. Create valuable content like blog posts and how-to guides that showcase your mobile wallet app's features and benefits.

- Public Relations (PR): Reach out to journalists, influencers, and industry publications to share your story and generate buzz around your app. Use press releases, interviews, and comprehensive media kits to facilitate media coverage.

Future Trends: Opportunities for Growth

The mobile wallet industry is rapidly evolving, and staying ahead of trends is essential for the success and growth of your app. Here are some future trends worth considering when creating and updating your mobile wallet app:

Contactless Payments

The demand for contactless payment solutions is rising due to the convenience, speed, and hygiene benefits they provide. Ensure that your mobile wallet app supports NFC-based or QR code-based contactless payments and stays up-to-date with any new developments in contactless payment technology.

Integration with Internet of Things (IoT) Devices

As the number of connected devices continues to grow, integrating your mobile wallet app with IoT devices like smartwatches, wearables, and smart home systems presents excellent opportunities to stay relevant in the market. Consider exploring partnerships with IoT device manufacturers and creating app extensions that bring a seamless payment experience to these devices.

Enhanced Security with Artificial Intelligence (AI)

Implementing AI and machine learning can help detect and prevent fraudulent activities in real-time, thus enhancing the security of your mobile wallet app. Invest in AI-driven tools that analyze transaction patterns and identify anomalies to flag suspicious activity before it causes financial harm to your users.

Expansion of Digital Loyalty Programs

Digital loyalty programs are a significant driver of user retention and engagement. Keep an eye on evolving trends in loyalty and reward program management, and consider introducing features like personalized offers, location-based rewards, and seamless integration of loyalty cards into your mobile wallet app to attract and retain users.

Developing a mobile wallet app like Google Pay or Apple Wallet can be a complex but rewarding endeavor. Following best practices, adopting the right technologies, and staying ahead of industry trends will improve your chances of creating a successful mobile wallet app that offers a seamless, secure, and compelling payment experience to users.

FAQ

Essential features include user registration, payment processing, QR code scanning, transaction history, peer-to-peer transfers, loyalty programs, digital card storage, and security protocols like biometric authentication.

Security considerations include data encryption, tokenization, multi-factor authentication, biometric authentication, secure storage of sensitive information, and compliance with financial industry security standards.

No-code platforms like AppMaster offer visual tools to design and develop mobile wallet apps without writing code, making the process faster and more cost-effective. They provide integrated development environments that can also streamline backend, web, and mobile application components.

Integrate payment gateways, banking APIs, card-issuing partners, device manufacturers' wallet APIs, location services for finding nearby merchants or ATMs, and email or SMS services for notifications.

Mobile wallet apps should follow guidelines from financial regulatory authorities, such as PCI DSS for payment processing, KYC/AML for user identification, and GDPR or CCPA for data privacy.

Develop a marketing strategy, start with a soft launch, gather user feedback, improve the app iteratively, and use app store optimization techniques. Leverage social media, content marketing, and public relations to spread the word.

Future trends include widespread adoption of contactless payments, integration with IoT devices, increased security measures using AI, and growth of digital loyalty programs.