No-Code in FinTech

Discover how the FinTech industry is leveraging no-code platforms like AppMaster to build innovative solutions, speed up development cycles, and achieve digital agility in the ever-changing financial landscape.

The FinTech industry and The Need for Agile Solutions

The financial technology (FinTech) industry has experienced tremendous growth over the past few years. Traditional financial institutions, as well as innovative startups, are leveraging technology to provide more efficient, cost-effective, and customer-centric services. With the rapid pace of change and an ever-evolving regulatory landscape, companies in the FinTech sector need tools and platforms that enable them to be agile, responsive, and able to deliver value to their customers quickly.

In the competitive FinTech market, the ability to quickly develop and launch new products and services is crucial for survival. FinTech companies must consistently innovate to keep up with changing customer demands and stay ahead of competitors. This necessitates an agile approach to software development, focusing on delivering solutions that cater to customer needs and evolve with the changing financial ecosystem. Traditional software development methodologies often require lengthy development cycles, significant resources, and extensive coding skills. This makes it difficult for financial service providers to adapt quickly to new opportunities and threats. Hence, there is a rising demand for alternative tools and frameworks that can accelerate the development of digital solutions in FinTech.

The Role of No-Code Platforms in FinTech

No-code platforms are emerging as a game-changer in the FinTech industry. They provide a way for companies to build software applications without the need for traditional coding or programming skills. By using visual interfaces, drag-and-drop design elements, and pre-built templates, no-code platforms enable both technical and non-technical users to create and deploy applications rapidly. FinTech companies can benefit significantly from adopting no-code solutions to build a wide range of financial applications, from mobile banking apps and payment processing tools to investment platforms and reporting systems.

By removing the complexity of coding, no-code platforms empower financial service providers to focus on their core services and deliver innovative digital products with reduced time-to-market. With no-code platforms, FinTech companies can achieve digital agility by streamlining development processes, iterating quickly, and adapting to new technologies and regulations in the ever-changing financial landscape. This gives financial service providers a competitive edge and allows them to stay ahead of new developments and meet customer demands.

Benefits of Integrating No-Code Solutions in FinTech

There are several tangible benefits of integrating no-code solutions into the FinTech development process.

- Faster time-to-market: No-code platforms accelerate application development by eliminating the need for traditional coding, reducing the time spent on coding and bug fixing. This allows FinTech companies to bring their products and services to the market faster and capitalize on emerging opportunities.

- Cost savings: No-code solutions can significantly reduce the development costs by minimizing the need for extensive developer resources. This cost savings can be passed on to customers in the form of more competitive pricing, while also improving the company's bottom line.

- Increased innovation: By lowering the barriers to entry for creating digital financial products, no-code platforms democratize the development process and promote innovation across the FinTech ecosystem. Companies of all sizes can tap into this creative potential to build new solutions that cater to niche markets and serve customer needs.

- Empowering non-technical team members: No-code platforms enable non-technical team members to contribute to the development process actively. This encourages collaboration among various departments, such as marketing, sales, and operations, and ensures that the final product aligns with business goals and user preferences.

- Enhanced security and compliance: Modern no-code platforms are designed with security and compliance in mind. They offer built-in mechanisms for encryption, authentication, and audit trails to ensure that financial applications adhere to industry standards and regulations.

- Integration with existing systems: No-code platforms often provide integration capabilities, allowing financial service providers to connect their no-code applications to existing systems and third-party services, creating seamless and customized digital experiences for their customers.

By adopting no-code solutions, FinTech companies can unlock numerous benefits that allow them to stay ahead in the competitive financial market, drive innovation, and create more value for their customers. With the rapid evolution of the FinTech landscape, integration of no-code platforms is becoming increasingly essential for businesses looking to adapt quickly and maintain a competitive edge.

Use Cases: How No-Code Is Disrupting Financial Services

No-code platforms have given rise to a new wave of innovation in the FinTech industry. By removing the barriers associated with traditional development methods, no-code has made it easier and more accessible for businesses to create and deploy financial applications and services. Here are some prevalent use cases for no-code in the FinTech sector:

Loan Management Systems

With no-code platforms, FinTech businesses can create comprehensive loan management systems (LMS) without code. These systems enable companies to automate loan origination, underwriting, servicing, and collections processes while maintaining compliance with industry regulations. By reducing manual efforts, LMS solutions built on no-code streamline operations, minimize human error, and allow for a faster and more efficient loan granting process.

Mobile Banking Applications

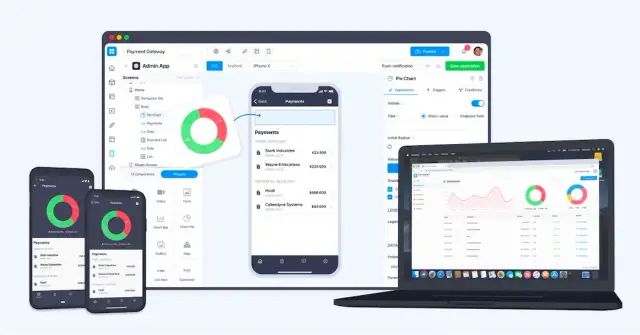

No-code platforms like AppMaster provide tools for creating user-friendly mobile banking apps without traditional programming. These apps can include features like account management, transaction tracking, budgeting, and financial goal setting. By enabling customers to access their financial data on-the-go, mobile banking apps empower individuals to take control of their financial lives and make informed decisions.

Investment Platforms

Using no-code, FinTech companies can design and deploy investment platforms to cater to both individual and institutional investors. These platforms can facilitate portfolio management, trade execution, and analysis, providing users with the tools they need to make informed investment decisions. Additionally, such platforms can include features like robo-advisors for personalized investment recommendations.

Payment Processing Tools

No-code platforms allow FinTech firms to build payment processing applications that make it easier for businesses and consumers to manage and process payments. By integrating various payment gateways and payment methods, companies can create seamless checkout experiences and reduce cart abandonment rates.

Financial Reporting and Analytics

Data-driven decision-making is crucial for the success of FinTech businesses. No-code platforms can be used to develop financial reporting tools that track key performance indicators (KPIs) and provide stakeholders with real-time insights, enabling informed decisions based on accurate data.

How AppMaster Is Empowering FinTech Companies with No-Code

AppMaster is a leading no-code platform that is transforming the way FinTech companies build and deploy their applications. With its powerful suite of tools, AppMaster enables businesses to create web, mobile, and backend applications rapidly, without the need for extensive coding knowledge. Here are some ways AppMaster is empowering FinTech companies with no-code:

Visual Data Models and Business Process Design

AppMaster simplifies building backend applications by allowing users to visually create data models (database schema) and business logic through the Business Process Designer. This eliminates the need for developers to manually write code to define data structures and business rules, saving time and effort.

Multi-layer Security and Compliance

AppMaster understands the critical importance of security and compliance in the FinTech industry. The platform provides built-in security features such as encryption, authentication, and audit trails, ensuring that FinTech applications adhere to industry standards and best practices.

REST API and WSS Endpoints

AppMaster allows FinTech companies to connect their no-code applications to existing systems and third-party services through the generation of REST API and WSS endpoints. This enhances the interoperability of the deployed solutions and maximizes their utility across different use cases.

Rapid Prototyping and Deployment

AppMaster drastically reduces the time and resources required to build and deploy FinTech applications. With the platform's visual tools, citizen developers and non-technical personnel can design and prototype applications rapidly, allowing businesses to respond more swiftly to market demands and capitalize on new opportunities.

Source Code and On-Premises Hosting

With AppMaster's Business and Enterprise subscriptions, FinTech companies have the option to obtain executable binary files or source code and host applications on-premises. This provides businesses with greater control over their FinTech solutions and ensures they can meet regulatory requirements.

Getting Started: Adopting No-Code for Your FinTech Business

To leverage the full potential of no-code platforms like AppMaster in your FinTech business, follow these steps:

- Define Your Objectives and Scope: Clearly outline your business objectives, focusing on the specific FinTech solutions you want to create or improve. Be sure to consider which aspects of your operation would benefit the most from the simplified development process offered by no-code platforms.

- Evaluate No-Code Platforms: Research different no-code platforms to find one that aligns with your business needs and industry requirements. Look for platforms with strong security features, integrated tools for FinTech-specific solutions, and client success stories within the industry.

- Train Your Team: Allocate resources to train your team on using the no-code platform. Ideally, choose a platform with a comprehensive learning program like AppMaster, which offers a free "Learn & Explore" subscription for new users and platform testing.

- Develop and Iterate: Start building your FinTech applications using the no-code platform. Engage in iterative development and test the apps throughout the process—seeking end-user feedback, making improvements, and leveraging platform capabilities to accelerate development.

- Integrate and Deploy: Once your FinTech applications are complete, integrate them with existing systems and third-party services to achieve seamless workflows and processes. Deploy your applications across the necessary environments, such as web, mobile, or backend, to ensure broad accessibility by your target audience.

By following these steps, your FinTech business can harness the power of no-code platforms like AppMaster and revolutionize its offerings, bolstering agility while providing innovative solutions in the ever-evolving financial industry.

FAQ

No-code in the context of FinTech means using no-code platforms to build and deploy financial applications and services without the need for traditional coding or programming skills.

No-code platforms can help FinTech companies rapidly create innovative solutions, reduce development time and costs, achieve digital agility, and empower non-technical personnel to participate in the development process.

No-code can be used in FinTech for developing loan management systems, mobile banking apps, investment platforms, payment processing tools, financial reporting, and more.

AppMaster offers a powerful no-code platform with features such as visual data models, business process design, REST API, and WSS endpoints, enabling FinTech companies to rapidly build and deploy web, mobile, and backend applications without coding.

Yes, modern no-code platforms are built with security and compliance in mind, offering features such as encryption, authentication, and audit trails to ensure that FinTech applications meet industry standards.

Yes, with AppMaster's Business and Enterprise subscriptions, FinTech companies can obtain executable binary files or source code to host applications on-premises.

Yes, with platforms like AppMaster, a single citizen developer can create comprehensive, scalable FinTech applications that include server backends, websites, customer portals, and native mobile apps.

Yes, no-code platforms often provide integration capabilities, allowing FinTech companies to connect their no-code applications to existing systems and third-party services.