How to Make a Real Estate Investment App like Fundrise or CrowdStreet?

Discover the process of creating a real estate investment app like Fundrise or CrowdStreet, from ideation to establishing a strong foundation for success and scalability in the property investment market.

Introduction to Real Estate Investment Apps

Real estate investment apps have revolutionized the way individuals and businesses participate in property investments, providing a digital platform for users to view and manage investment opportunities conveniently. These platforms remove traditional barriers to entry by providing a market for fractional ownership, allowing smaller investors to enter the real estate sector and diversify their investment portfolios.

With increased accessibility to real estate investments and the growing popularity of online platforms, developing an application that caters to the evolving demands of users can help you capture a share of this expanding market. To create a successful real estate investment app, you need to analyze existing market players, identify the essential features and functions that attract users, and design a user-friendly and scalable platform that satisfies investors' needs.

Understanding Fundrise and CrowdStreet

Fundrise and CrowdStreet are two popular real estate investment platforms that have garnered a substantial user base due to their innovative approach to property investment. Understanding their model and business strategies will help you recognize the key elements that make a real estate investment app successful.

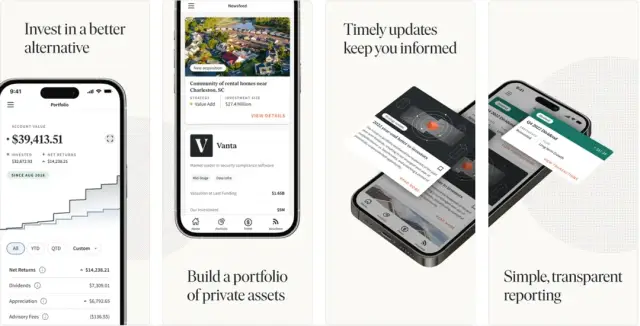

Fundrise is a real estate crowdfunding platform founded in 2010, offering a simplified way for everyday investors to gain access to a diversified pool of commercial real estate investments. On Fundrise, investors can start investing with as little as $500 and gain exposure to a diversified portfolio of properties through eREITs (electronic Real Estate Investment Trusts). This model enables smaller investors to invest without the traditional entry barriers associated with real estate. Fundrise offers investors various investment plans based on risk tolerance and investment objectives, with returns generated through rental income, asset appreciation, and dividends.

CrowdStreet, founded in 2013, is another real estate crowdfunding platform that specializes in offering commercial property investment opportunities to individual accredited investors. Unlike Fundrise, CrowdStreet allows investors to invest in individual properties or build their portfolios with a minimum investment typically starting at $25,000. CrowdStreet focuses on providing transparency, detailed investment information, and opportunities for investors to participate in real estate projects with strong potential returns.

Both platforms have made their mark in the real estate investment sector by providing users with an easy-to-use interface, extensive investment options, and a strong emphasis on transparency. Drawing insights from these platforms can help shape the development of your real estate investment app.

Essential Features for a Real Estate Investment App

To develop a successful real estate investment app, it is crucial to include essential features that cater to the needs of investors and ensure smooth operation. The following features are essential for any aspiring real estate investment platform:

- User Registration and Authentication: Implement secure user onboarding by requiring registration and authentication through email or social media accounts. Have a thorough Know Your Customer (KYC) process to validate investor identity and comply with regulatory requirements.

- Investment Deals and Opportunities Listing: Present investment opportunities to users in an organized, accessible manner. Include key information such as property location, investment amount, projected returns, and more.

- Advanced Search and Filters: Enable users to search and filter properties based on their preferences, such as geographical location, property type, risk level, return on investment, and budget.

- Property and Portfolio Management Tools: Equip users with the ability to manage their invested properties and overall portfolios, track the performance of individual assets, and monitor their investment goals.

- Investment Calculator and Analytics: Facilitate informed decision-making through investment calculators and provide personalized analytics to help users project their potential returns, evaluate risks, and analyze performance.

- Document Management: Offer a secure, centralized location for users to store and access vital documents related to their investments, such as legal agreements, financial statements, and property reports.

- Messaging and Support: Provide seamless communication within the platform for users to interact with investment professionals, ask questions, and receive guidance or support in their investment journey.

- Payment Gateway Integration: Implement a secure, reliable payment gateway for processing transactions and ensuring the safe and efficient flow of funds.

- Notifications and Alerts: Send users timely updates and reminders about investment opportunities, deal statuses, and platform news through in-app notifications, email, or text messages.

By incorporating these critical features, your real estate investment app will be better positioned to offer a competitive, comprehensive solution for individuals looking to break into the property investment market.

Technical Architecture for a Real Estate Investment App

Creating a real estate investment app like Fundrise or CrowdStreet requires an efficient technical architecture that can support the needs of thousands of users, safeguard sensitive financial data, and deliver an excellent user experience. The components of such an architecture should include:

Frontend

The frontend serves as the interface between users and the app. It should be designed using modern technologies like Vue.js, React, or Angular, taking into consideration mobile responsiveness, cross-platform compatibility, and accessibility. An excellent frontend, coupled with attractive UI/UX design, will engage users and motivate them to invest in your platform.

Backend

The backend is responsible for processing user requests, managing application data, handling business logic, and communicating with third-party applications and APIs. Technology stacks such as Node.js, Ruby on Rails, Django, or Laravel can be used. It is essential to maintain a clean, well-documented codebase to facilitate scalability and decrease maintenance costs in the long run.

Database

Real estate investment apps need a powerful database system to store massive amounts of data related to users, listings, and transactions. Modern databases like PostgreSQL, Microsoft SQL Server, or Amazon RDS can be employed, with appropriate security measures, backup systems, and optimized queries to ensure data integrity and access efficiency.

APIs and Integrations

A successful real estate investment app interacts with various external services such as payment gateways, customer support tools, and analytical platforms. API integrations are essential for seamless communication between your app and these services. Choose RESTful APIs when possible and ensure secure connections through authentication and access control mechanisms.

Cloud Infrastructure and Hosting

A cloud-hosted infrastructure is recommended due to its flexibility, maintenance, and cost-effectiveness. Providers like Amazon Web Services (AWS), Microsoft Azure, or Google Cloud Platform (GCP) can be employed, and containerization tools such as Docker and Kubernetes may be used to manage and deploy the app.

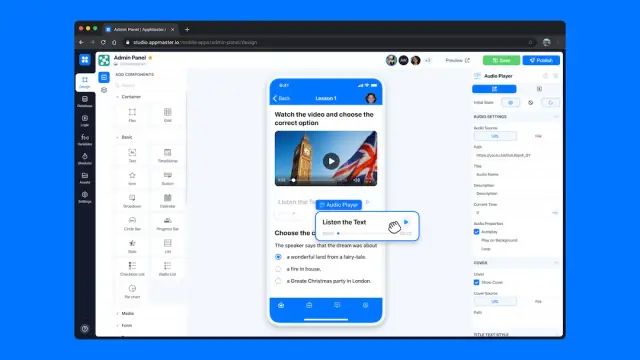

Choosing Your Development Method: Low-Code/No-Code Vs Custom Development

Deciding between low-code/no-code platforms and custom development for your real estate investment app can be challenging. Both approaches have their benefits and limitations. The choice depends on your project requirements, budget constraints, and long-term goals.

Low-Code/No-Code Development

Low-code/no-code platforms like AppMaster offer a visual, drag-and-drop interface for developing applications without requiring expert coding knowledge. By using these platforms, you can benefit from:

- Speed: Low-code/no-code platforms can greatly reduce development time, allowing for faster time-to-market.

- Cost Savings: Reduced development efforts mean lower expenses, making this approach suitable for startups and small businesses.

- Ease of Use: These platforms are accessible to non-developers and developers alike, allowing for collaboration across teams.

However, they may have limitations on customization and flexibility, especially when dealing with complex projects.

Custom Development

Custom development involves creating an application from scratch with a team of skilled developers. It offers benefits such as:

- Flexibility: Custom development allows for maximum customization to meet unique requirements and adapt to evolving market trends.

- Competitive Edge: A tailored app can outshine competitors by offering features and capabilities that low-code/no-code solutions might not provide.

On the downside, custom development may entail higher costs, a longer development timeline, and increased maintenance efforts.

App Scalability and Handling High-Volume Traffic

Real estate investment apps should be scalable to accommodate increasing user traffic and growing numbers of properties, transactions, and data. Implementing the following strategies can ensure your app is prepared to handle high-volume traffic:

- Microservices Architecture: Divide your app into smaller, independent components called microservices. Each microservice is responsible for a specific function, allowing for better scalability and maintenance of the overall system.

- Load Balancing: Distribute incoming network traffic evenly across multiple servers to prevent any single server from getting overloaded, ensuring optimal performance and availability.

- Database Optimization: Keep database queries efficient by using caching, indexing, and query optimization techniques. Monitoring database performance regularly can help identify and rectify potential bottlenecks.

- Optimizing Frontend Assets: Minimize frontend assets by compressing images and using Content Delivery Networks (CDNs) to reduce load times and improve user experience.

- Auto-Scaling Cloud Infrastructure: Utilize cloud infrastructures that offer auto-scaling capabilities, allowing your app to automatically adjust its computing resources based on demand.

Optimizing your app for high-traffic scenarios not only enhances its performance but also ensures a seamless experience for users, boosting your app's credibility and attracting new investors.

Maintaining Security and Compliance

Security and compliance in a real estate investment app should never be compromised, as these applications involve sensitive financial information and transactions. To ensure that your app meets the highest levels of security and compliance, consider the following essential measures:

- Data Encryption: Use data encryption both in transit and at rest to protect users' confidential information. Employ secure communication protocols such as HTTPS and TLS to safeguard data transmitted between the app and server, and encrypt stored data using industry-standard encryption methods like AES-256.

- Secure Data Storage: Select a secure and compliant cloud service provider for your app's data storage needs. Verify that the provider adheres to global data protection standards, undergoes regular security audits, and has strong backup and disaster recovery processes in place. This will minimize the risk of data breaches and ensure data availability in the event of unforeseen incidents.

- Secure API Integrations: APIs allow your real estate investment app to communicate with third-party services such as payment gateways, analytics tools, and property information providers. Ensure that all APIs used in your app are secure and properly authenticated using mechanisms like API keys, OAuth, or OpenID Connect, to prevent unauthorized access or data leakage.

- Access Control and Authentication: Implement an access control system with multiple layers of authentication such as email verification, two-factor authentication (2FA), and biometric authentication to protect your users' accounts. Additionally, ensure that your app has granular permission levels for different types of users – administrators, investors, property managers – restricting access to sensitive information and features based on user roles.

- Privacy Policy and Terms of Service: Create comprehensive privacy policies and terms of service that inform users of how their data is captured, stored, processed, and shared. Your privacy policy should outline the types of data collected, the purpose of collection, and users' rights in regards to their data. Ensure that your app complies with data protection regulations like the General Data Protection Regulation (GDPR) and California Consumer Privacy Act (CCPA).

- Regular Security Testing and Audits: Conduct thorough security assessments such as penetration testing, vulnerability scanning, and code reviews to identify and address any potential security threats or weaknesses. Regularly evaluate your app's security measures and make improvements as needed, keeping abreast of industry best practices and emerging threats.

Monetization and Revenue Strategies

Deploying an effective monetization strategy is crucial to ensure the financial success and long-term sustainability of your real estate investment app. Consider the following strategies:

Commission-Based Revenue

Earn a commission from each investment deal facilitated through your app. This can be a fixed percentage of the investment amount or a flat fee for each transaction. The commission strategy aligns your interests with that of your users, encouraging engagement and value creation.

Membership or Subscription Fees

Offer premium features and services such as advanced analytics, priority access to investment opportunities, and personalized investment advice, through a membership or subscription model. Users can be charged a monthly, quarterly, or annual fee to access these exclusive benefits.

Sponsored Listings and Promotions

Charge property developers or managers for promoting their investment opportunities on your platform, either as sponsored listings or through other forms of advertising. This strategy can provide an additional revenue stream while enhancing the visibility of select investment opportunities for your users.

In-App Advertisements

Integrate unobtrusive banner ads or native advertisements within your app's interface, partnering with relevant real estate service providers such as mortgage brokers, property inspectors, and legal advisors. This method can generate ad revenue without detracting from the user experience.

Partnerships

Forge strategic partnerships with real estate service providers, influencers, and media outlets to create mutually beneficial marketing and revenue-sharing opportunities. This can accelerate your app's growth while opening up new revenue streams.

Marketing Your Real Estate Investment App

A well-executed marketing strategy plays a vital role in attracting and retaining users for your real estate investment app. Consider the following marketing initiatives:

Social Media Marketing

Create and maintain a strong presence on social media platforms such as Facebook, Instagram, Twitter, and LinkedIn. Share updates, success stories, informational content, and attractive visuals to engage your target audience and drive app downloads.

Email Marketing

Build and nurture an email subscriber list to share engaging newsletters, investment opportunities, and valuable content with your audience. Use email marketing automation tools to plan, execute, and track the effectiveness of your campaigns.

Content Marketing

Develop and share high-quality, informative content such as blog posts, videos, podcasts, and infographics focused on real estate investment topics. This will establish your app as a credible source of industry knowledge and attract potential users to your platform.

Search Engine Optimization (SEO)

Optimize your app's website and content for search engines, focusing on relevant keywords and phrases related to real estate investment. Use on-page and off-page SEO techniques to improve your site's visibility and drive organic traffic.

Influencer Collaborations

Partner with industry influencers, content creators, and thought leaders to expand your app's reach, credibility, and user base. Collaborations can include sponsored content, reviews, endorsements, or even joint webinars and events.

Referral Programs

Encourage users to refer your app to friends, family, and colleagues by offering incentives such as discounts, bonus offerings, or exclusive access to premium features. A referral program can help drive user acquisition through the power of word-of-mouth marketing.

By diligently addressing security and compliance concerns, establishing the right monetization strategy, and executing a strong marketing plan, your real estate investment app will be primed for success in the competitive property investment market.

Future Outlook: Emerging Technologies in Real Estate Investment Apps

The real estate investment sector is continually evolving, with emerging technologies transforming the way people manage and invest in properties. Incorporating cutting-edge technologies into your app will not only improve the user experience but also help your app stay ahead of the competition. Here are a few key emerging technologies you can consider integrating into your real estate investment app:

Artificial Intelligence and Machine Learning

AI and Machine Learning can analyze vast datasets to deliver insights and recommendations to users. Integration of these technologies can help improve property valuations, forecast investment returns, and optimize property search, making the entire process more user-friendly and efficient. Algorithms can automatically match users with suitable investment opportunities based on their preferences and investment goals, facilitating more accurate and targeted connections within the app.

Big Data Analytics

Real estate investment decisions depend on the analysis of vast amounts of data. Big data analytics allows you to process and analyze this data to deliver crucial insights to your users. This lets investors make well-informed decisions by understanding market trends, demographic information, and other relevant factors. By offering actionable insights based on data analytics, your app can enhance its value proposition to users and attract more users who value data-driven investing.

Blockchain Technology

Blockchain can revolutionize the real estate investment app environment by offering increased transparency, security, and decentralized control. Tokenization of assets through blockchain can enable fractional ownership of properties, allowing even small investors to participate in investment opportunities. Smart contracts can be used to automate transactions and processes, reducing the need for intermediaries, and speeding up investment deals. Furthermore, the decentralized nature of blockchain provides added security and trust in the validity of transactions within the app.

Virtual Reality and Augmented Reality

Virtual Reality (VR) and Augmented Reality (AR) can significantly enhance the experience of property listings and site visits in your app. Users can explore properties in an immersive 3D environment without visiting the actual location, saving time and resources. This can also attract international investors who may not have the opportunity to visit properties in person. Including VR and AR capabilities in your app can set your platform apart from competitors, especially if you target a global audience of real estate investors.

Conclusion

Developing a real estate investment app like Fundrise or CrowdStreet can be an exciting and rewarding endeavor. By understanding the essential features, technical architecture, development methods, and different monetization strategies, you can create a powerful app that attracts users and generates revenue. Don't forget to prioritize security, compliance, and scalability, as they are critical for a successful app in the real estate investment market.

Using platforms like AppMaster.io can be a game-changer for businesses looking to develop their real estate investment app with a low-code/no-code solution. It allows you to focus on app functionality and user experience while reducing the time-to-market and development costs. Ultimately, staying informed of emerging technologies and incorporating them into your real estate investment app can help your platform stay ahead of the competition and thrive in the ever-evolving world of property investing.

FAQ

Some key features include user registration and authentication, investment deals and opportunities listing, advanced search and filters, property and portfolio management tools, investment calculator, investment analytics, document management, messaging and support, payment gateway integration, and notifications.

Evaluate low-code/no-code platforms like AppMaster and custom development by comparing factors such as budget, expertise, project complexity, time to market, flexibility, scalability, and overall business goals.

Security and compliance are paramount in real estate investment apps, as they involve sensitive financial information and transactions. Ensure features like encryption, secure data storage, secure API integrations, and adherence to regulations like GDPR and CCPA.

Common monetization methods include commission-based revenue, membership or subscription fees, sponsored listings, in-app advertisements, and partnerships with real estate service providers.

Leverage social media marketing, email marketing, content marketing, search engine optimization, influencer collaborations, and referral programs to attract and retain users.

Emerging technologies like artificial intelligence, machine learning, big data analytics, blockchain, and virtual reality can enhance user experience, improve decision-making, and streamline operations within the app.