How to Build a Budgeting App like Mint or YNAB?

Discover the ins and outs of creating a successful budgeting app like Mint or YNAB. Learn about the essential features, development process, monetization strategies, and more.

Introduction to Budgeting Apps and their Popularity

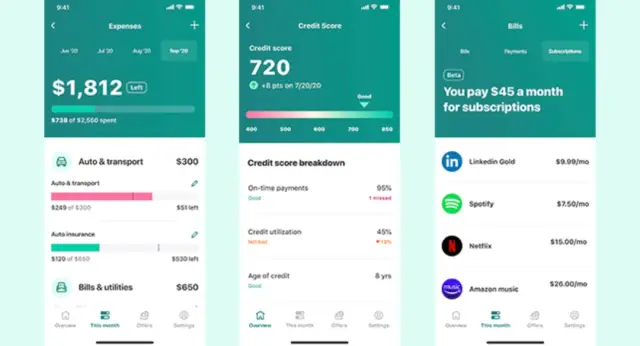

In today's fast-paced world, managing personal finances has become an essential skill for achieving financial stability and success. With the rise of mobile technology and the availability of smartphones, budgeting apps have gained significant popularity among users. Top budgeting apps like Mint and YNAB (You Need A Budget) have set a gold standard for personal finance management, offering tools to track expenses, set budgets, and improve overall financial health.

The increasing popularity of budgeting apps can be attributed to several factors. Firstly, the convenience of managing finances on-the-go has become important for users who prefer having a consolidated view of their income, expenses, and financial goals. Secondly, the real-time tracking and categorization of transactions allow users to maintain better control of their spending habits. Finally, budgeting apps provide valuable insights and recommendations to help users make smarter financial decisions and achieve their long-term objectives. This article will discuss the key features of a budgeting app and explore the development process, starting with establishing a secure connection to banks.

Key Features of a Budgeting App

To create a successful budgeting app like Mint or YNAB, it is crucial to include essential features that cater to users' needs and preferences. The following are some key features you should consider incorporating into your budgeting app:

- Automatic Transaction Synchronization: Connect to users' bank accounts and credit card providers to automatically fetch and update their transaction data in the app, providing them with an up-to-date financial overview.

- Expense Categorization: Organize transactions into various categories, such as groceries, utilities, or entertainment, for easier tracking and analysis. This feature helps users understand their spending habits better and identify areas to cut down on expenses.

- Budgeting Tools: Enable users to create customizable budgets for different categories, so they can allocate funds accordingly and monitor their progress towards financial goals.

- Financial Goal-Setting: Offer tools for users to set short-term and long-term financial goals, such as saving for a vacation or paying off debt, and track progress towards achieving those goals.

- Analytics and Reporting: Generate comprehensive reports and insightful visualizations of users’ financial data, assisting them in making informed decisions and monitoring their financial progress.

- Notifications and Alerts: Send timely notifications and alerts to users regarding important financial events, such as upcoming bills, account balances, or budget overages, to help them stay on top of their finances.

Establishing a Secure Connection to Banks

For any budgeting app, it is essential to establish a secure connection to banks and other financial institutions where users hold their accounts. A reliable and encrypted connection is necessary not only to protect users' sensitive financial data but also to maintain their trust and ensure compliance with industry regulations. To establish such a connection, you can use third-party platforms called data aggregators that facilitate safe communication between your app and users' bank accounts. These platforms - Plaid, Yodlee, Tink, or TrueLayer, for example - securely collect and aggregate users' financial information, providing you with a secure API to access and display the data in your app.

By integrating these APIs, you can streamline the automatic synchronization of transactions and account updates. When choosing a data aggregator, it is crucial to consider their compatibility with your app's target audience and the financial institutions you wish to connect to, along with the level of security they provide. Additionally, consider the pricing and available features, as they might vary between different platforms. Incorporating data aggregators and integrating their APIs into your app ensures secure communication between your app and banks, helps maintain user trust, and allows you to offer a seamless, up-to-date financial experience to your users.

Integrating Third-Party APIs

Integrating third-party APIs (Application Programming Interfaces) into your budgeting app can streamline development, enhance functionality, and reduce costs. Third-party APIs allow you to access external services and data and seamlessly integrate them into your app, providing a variety of features without reinventing the wheel. In this section, we'll delve into the types of APIs you should consider when building a budgeting app and their benefits.

Data Aggregation APIs

One of the most critical aspects of any budgeting app is access to users' financial account data. Synchronizing transaction data from multiple banks and financial institutions is made possible through data aggregation APIs. Services like Plaid, Yodlee, and TrueLayer are examples of API providers that focus specifically on financial data aggregation. By integrating with these services, your app can retrieve users' transaction history, account balances, and other relevant financial information, enabling accurate and up-to-date budget management.

Financial Insights APIs

To offer users valuable financial insights, you can integrate your app with financial insights APIs. These APIs enable the analysis of users' spending habits, categorization of transactions, detection of unusual activities, identification of trends, and even suggestions for improved money management. A service like Quodd, for instance, can deliver financial market data that can aid users in making knowledgeable investment decisions.

Authentication and Security APIs

As your app will be handling sensitive financial data, ensuring a high level of security should be a top priority. Integrating third-party APIs, such as OAuth or OpenID Connect, can offer seamless and secure authentication mechanisms. These APIs allow you to verify your users without requiring them to create and remember yet another username and password. Additionally, these APIs can provide an extra layer of security by implementing two-factor authentication (2FA) or multi-factor authentication (MFA).

Payment Processing APIs

If your budgeting app involves making transactions or facilitating payments, you will need to integrate a reliable payment processing API. Providers like Stripe, Square, or PayPal offer secure and efficient payment processing that can be easily integrated into your app.

Designing an Intuitive User Experience

One of the critical factors in the success of any app is a user-friendly interface and a smooth user experience (UX). An intuitive design allows users to comprehend and navigate the app easily, making them more likely to continue using it for their financial management needs. In this section, we will discuss some essential design considerations for creating an engaging user experience in a budgeting app.

Clear and Simple Navigation

A well-organized navigation menu allows users to find and access the features they need without hassle. Ensure that your app's primary functions are easy to locate, and avoid cluttering the interface with unnecessary buttons or options. Utilizing a hierarchical navigation model can provide a clear path for users to follow, reducing confusion and improving user satisfaction.

Visualizing Data with Charts and Graphs

Financial data can be challenging to digest and understand when presented as raw numbers. Transforming this information into visually appealing and easy-to-comprehend graphics can significantly improve user engagement. Consider incorporating pie charts, bar graphs, or line charts to display transaction data, income and expense breakdowns, and trends over time.

Responsive Design

Ensure that your app has a consistent and responsive design across various devices, screen sizes, and platforms. This enables users to access and manage their budgets with ease, regardless of the device they are on. Make use of adaptable layouts, scalable vector graphics, and appropriate visual elements to deliver a polished and professional user experience.

Personalization

Personalizing your app's interface can make users feel more connected and engaged with their financial management. Consider offering customizable features such as color schemes, avatars, and the ability to create custom categories for better expense tracking.

App Development: No-Code vs Traditional Approach

When building a budgeting app, the development approach you choose will have significant implications for the project's timeline, cost, and scalability. In this section, we will discuss the pros and cons of using a no-code platform like AppMaster versus a traditional custom development approach.

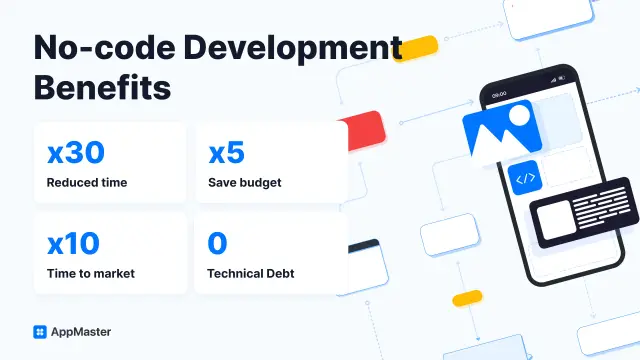

No-Code Development Platforms

No-code platforms, such as AppMaster, allow developers and non-developers alike to build web, mobile, and backend apps without writing any code. These platforms offer a visual and user-friendly interface for designing app features, including data models, business logic, and user interfaces. Some benefits of using no-code platforms for budgeting app development include:

- Rapid Development: By eliminating the need for manual coding, no-code platforms significantly speed up the app development process, allowing you to bring your budgeting app to market faster.

- Reduced Costs: With no-code platforms, you can drastically cut down on development costs, making them an appealing option for startups or small businesses with limited budgets.

- Scalability: No-code platforms like AppMaster generate source code for applications, which can result in scalable and high-performance apps, suitable for enterprise and high-load use cases.

- Elimination of Technical Debt: With no-code platforms, every time there is a change in app requirements, the platform generates the application from scratch, removing the need to worry about maintaining and updating legacy code.

Traditional Development Approach

The traditional development approach involves hiring developers or a development team to create a custom app using standard programming languages and frameworks. While this method can result in a highly tailored app, it comes with several drawbacks:

- Increased Time and Cost: Custom app development requires significantly more time and resources than using no-code platforms, resulting in higher costs and longer time-to-market.

- Higher Skill Requirements: Manual coding necessitates skilled developers proficient in various programming languages and frameworks, which can be challenging to find and expensive to employ.

- Technical Debt and Maintenance: A custom app will accumulate technical debt over time, requiring ongoing maintenance and updates to remain efficient and functional.

While the traditional approach can deliver a bespoke budgeting app, the benefits of using a no-code platform like AppMaster in terms of time, cost, and scalability make it an increasingly popular choice for businesses and entrepreneurs entering the fintech space.

Considering Compliance and Security Measures

Building a budgeting app like Mint or YNAB not only requires functionality and an intuitive user experience but also mandates adherence to stringent security and compliance requirements. As the sensitive nature of financial data makes it a prime target for cyberattacks, your app must take appropriate measures to ensure user privacy and data protection.

Data Encryption

To prevent unauthorized access to user data, employ end-to-end encryption throughout the budgeting app. Secure Socket Layer (SSL) technology and Transport Layer Security (TLS) are widely used to encrypt data transmission between the app and servers.

Secure Data Storage

Choose a reputable cloud storage provider that guarantees secure data storage and complies with global and regional data protection regulations. Opt for providers that offer regular data backups, physical security measures, redundancy, and scalable storage options.

User Authentication

Use multi-factor authentication (MFA) to enhance the security of the budgeting app. Combining password protection with a secondary authentication method, such as a biometric verification or a time-based one-time password (TOTP), adds an extra layer of security to the user accounts.

Compliance with Financial Regulations

As a budgeting app developer, it's essential to comply with financial industry regulations, such as the General Data Protection Regulation (GDPR) or the California Consumer Privacy Act (CCPA). These regulations ensure user privacy and data protection by stating how companies can collect, store, and process user information. Non-compliance could lead to penalties and legal consequences, which could harm your app’s reputation and user trust.

Regular Security Audits

Conduct regular security audits to identify potential vulnerabilities and areas that need improvement. Third-party security firms can be engaged for penetration testing or vulnerability assessments, which can help discover weaknesses before they can be exploited by attackers.

Marketing and Monetization Strategies

After building and ensuring the security and compliance of your budgeting app, it's time to create a marketing strategy that raises awareness and attracts users. Additionally, you need to have a solid monetization plan in place to generate revenue.

Social Media Promotion

Leveraging social media platforms like Facebook, Twitter, and LinkedIn can be an effective way to reach potential users. Create engaging content that highlights your app's unique features and demonstrates how it can help users improve their financial management.

Content Marketing

Create useful resources, such as blog posts, guides, and infographics about personal finance management, budgeting tips, and the benefits of your app. This approach can not only bring traffic to your app's website but also establish your brand as an authority in the budgeting and personal finance niche.

Influencer Partnerships

Partner with influencers in the personal finance and budgeting space to promote your app. Influencers can showcase your app's features and benefits to their audience, increasing your app’s visibility and potentially driving more downloads.

App Store Optimization (ASO)

Optimize your app's listing on app stores by using relevant keywords, adding an engaging description, and showcasing visually appealing screenshots or videos. ASO can help improve search rankings and increase the visibility of your budgeting app.

Monetization Options

Revenue streams for budgeting apps may include premium features, in-app advertising, affiliate marketing, or a subscription model. Consider your target audience and app's primary purpose when deciding on the most appropriate monetization strategy.

Conclusion

Building a budgeting app like Mint or YNAB requires a comprehensive understanding of the market and users' needs. By incorporating essential features, ensuring the app's security and compliance, and developing an effective marketing and monetization strategy, you can create a budgeting app that stands out in the crowded fintech space. Keep in mind that developing a budgeting app using traditional methods can be time-consuming and costly. However, by leveraging a no-code platform like AppMaster, you can expedite the development process, reduce costs, and bring your app to market faster while eliminating technical debt. By diligently focusing on these elements, you're well on your way to creating a successful and secure budgeting app that helps users better manage their finances and achieve their financial goals.

FAQ

Budgeting apps like Mint and YNAB offer users an efficient way to manage their finances, set financial goals, track expenses, and gain valuable insights into their financial habits.

A successful budgeting app should include features such as automatic transaction synchronization, expense categorization, budgeting tools, financial goal-setting, analytics and reporting, and notifications for relevant updates and activities.

A secure connection to banks is necessary for a budgeting app to ensure users' financial data remains protected, maintain user trust, and comply with industry regulations.

Third-party APIs are pre-built services or tools that allow apps to access external data and functionality more efficiently. Integrating them into your budgeting app can save development time and provide additional features, such as financial insights, data aggregation, and secure authentication.

An intuitive user experience is essential for a budgeting app to help users quickly understand and navigate through the app, make data-driven decisions, and ultimately improve their financial management.

A no-code approach like AppMaster can significantly speed up the development process, reduce costs, and allow for rapid prototyping and iteration, enabling you to bring your budgeting app to market faster.

Developers should consider implementing strong data encryption, secure data storage, user authentication, and ensuring compliance with financial industry regulations such as GDPR or the CCPA.

Marketing strategies include social media promotion, content marketing, influencer partnerships, and app store optimization. Monetization may be achieved through premium features, in-app advertising, affiliate marketing, or a subscription model.