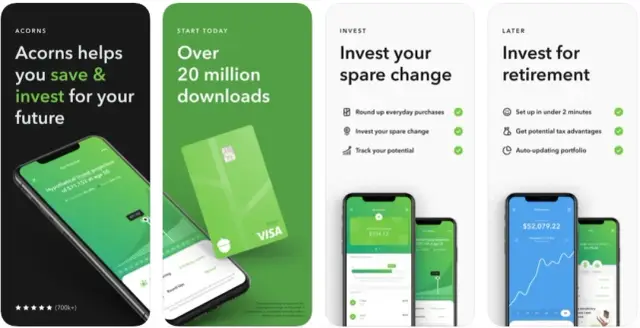

How to Develop a Personal Finance App like Acorns?

Discover how to build a personal finance app like Acorns using no-code development principles, and explore the benefits and key features to include for success.

Acorns is a popular personal finance app designed to help users save money, invest, and improve their financial habits. The app offers various features that enable its users to automate their savings, make informed financial decisions, and pursue long-term wealth creation. Some of the primary features of Acorns include:

Micro-investing: Acorns allows users to invest their spare change by rounding up their purchases from linked payment methods and investing the difference into a diversified portfolio.

Retirement planning: Users can also set up retirement savings accounts with Acorns Later, which offers a selection of low-cost Individual Retirement Accounts (IRAs).

Checking account services: Acorns Spend is a checking account that integrates with the app to provide quick access to funds, direct deposit, and mobile check deposit features.

Cashback rewards: The app offers cashback on purchases made at partner merchants through its Found Money program, with the earned cashback being directly invested into the user's portfolio.

Financial literacy content: Acorns provides a range of educational articles and resources known as "Grow" to help users understand the basics of personal finance, improve their financial habits, and make informed decisions.

Advantages of Building a Personal Finance App

Creating a personal finance app like Acorns can offer numerous benefits to both app developers and their target users. These benefits include:

- Providing financial control: A well-designed personal finance app empowers users to gain better control of their finances, set budgets, and track spending with ease.

- Offering financial guidance: Through educational resources, personalized recommendations, and investment options, a personal finance app can help users make better financial decisions.

- Encouraging savings and investments: By automating the process of saving and investing, a personal finance app can encourage users to build wealth over time, making it a valuable tool for long-term financial planning.

- Creating revenue streams: As an app developer, you can generate revenue through various means such as subscription plans, freemium models, in-app purchases, or referral programs.

- Growing market demand: Given the increasing consumer focus on personal finance management and financial wellness, the demand for personal finance apps has grown considerably, making it an attractive market for app developers.

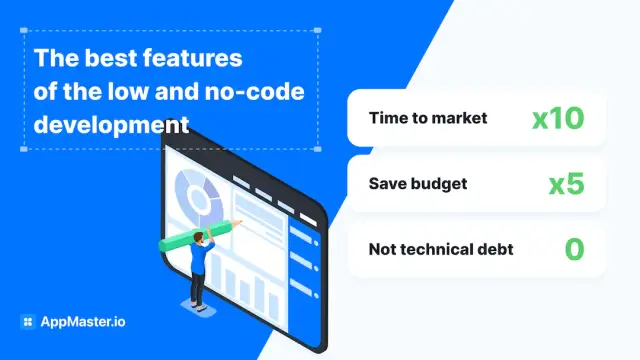

Choosing the Right No-Code Development Platform

Developing a personal finance app like Acorns can be simplified and accelerated by leveraging no-code development tools. No-code platforms offer several benefits, including reduced development time, cost savings, straightforward customization, and elimination of technical debt. However, it's essential to choose the right no-code platform to meet your app's specific requirements:

- Comprehensive features: Look for a no-code platform that offers a wide range of features and functionalities, such as database schema creation, business logic configuration, REST API generation, and native mobile application support.

- Customization options: The ability to easily modify and personalize the app to match your desired design and feature set is crucial. Choose a no-code platform with powerful customization capabilities.

- Scalability: Your chosen no-code platform should enable your app to scale efficiently and cater to increasing user growth and resource demands.

- Security and compliance: Given the sensitive nature of financial data, your no-code platform should support industry-standard encryption, authentication, and compliance with relevant financial regulations.

- Customer support: A strong support system and access to comprehensive documentation will ensure you can address any issues or challenges during the app development process. An excellent option for a no-code platform to build a personal finance app like Acorns is AppMaster. This powerful platform allows you to create backend, web, and mobile applications with a wide range of features and high customization potential. With AppMaster.io, you can develop a user-friendly, feature-rich, and secure personal finance app that caters to your target audience's needs.

Important Features to Include

Developing a personal finance app like Acorns requires a solid understanding of the key features that users expect from such a tool. To create a competitive product, focus on the following essential features to ensure your app offers the functionality and user experience necessary for success in the financial technology space:

- Budget planning: Assist users in creating and managing budgets by allowing them to input their income, expenses, and financial goals. Offer suggestions and customizable budget templates that cater to specific needs and preferences.

- Expense tracking: Help users track and categorize their spending through transactions syncing from their linked bank accounts or manual input. Offer insights into spending patterns and recommend ways to optimize expenses and save money.

- Financial goal setting: Encourage users to set short-term and long-term financial goals, such as saving for a vacation, paying off debt, or investing for retirement. Provide progress tracking and milestones to keep users motivated and on track.

- Investment management or recommendations: Offer features similar to Acorns' micro-investing and portfolio management, where users can invest in a diversified portfolio of stocks, bonds, and other assets. Provide tailored investment advice based on users' financial goals, risk tolerance, and investment horizon.

- Financial education resources: Equip users with the knowledge and tools to make informed financial decisions by providing access to financial articles, tutorials, and webinars on various topics, such as budgeting, debt management, and investing.

- Notifications and alerts: Keep users informed about their financial status by sending custom notifications, reminders, and alerts regarding upcoming bills, savings goals progress, investment opportunities, and important account updates.

- Multi-device support and synchronization: Ensure that users can access and manage their finances from multiple devices, like smartphones, tablets, and desktops, with seamless data synchronization between devices for a consistent user experience.

Integration with Third-Party APIs

Integrating your personal finance app with third-party APIs is essential to provide a seamless experience for users when accessing their banking data, investments, and other financial services. Consider the following APIs to enhance your app's functionality and data access:

- Plaid: Use the Plaid API to connect users' bank accounts securely, retrieve transactions, and access account balances. Plaid simplifies the process of integrating with various financial institutions and offers support for multi-factor authentication.

- Yodlee: Like Plaid, Yodlee provides a comprehensive API for accessing banking data from a wide range of financial institutions. Yodlee also offers additional features such as credit score and report access, which can be useful for enhancing your app's functionality.

- Xignite: Integrate Xignite's APIs to access market data, financial news, and historical data for stocks, currencies, commodities, and more, which can be valuable for users interested in investing or monitoring their portfolios.

- Payment APIs: If your personal finance app provides any form of payment, integrate with popular payment APIs such as Stripe, PayPal, or Square. These APIs make it easier to process payments securely and offer a variety of mobile and web payment options to users.

When selecting APIs, evaluate their features, security measures.

Ensuring Security and Compliance

Security and regulatory compliance are critical aspects of building personal finance apps like Acorns, as users expect their sensitive financial data to be protected responsibly. Implement the following steps to guarantee security and compliance:

- Data encryption: Ensure that your app supports encryption for data storage, including data at rest and in transit. Integrate with third-party APIs that use encryption for data transmission, such as SSL/TLS, to protect sensitive user information.

- Authentication and authorization: Implement secure user authentication using methods like multi-factor authentication (MFA), single sign-on (SSO), or social media login. In addition, provide role-based access control for your app to limit user access to designated features.

- Monitor and manage vulnerabilities: Regularly assess your app for vulnerabilities and apply necessary security patches, updates, or code revisions. Use tools and services that monitor and detect potential threats or suspicious activity for proactive security management.

- Comply with regulatory requirements: Adhere to financial regulations such as the GDPR, CCPA, or the Payment Card Industry Data Security Standard (PCI-DSS) for regional and industry-specific compliance. Stay informed about any changes to relevant regulations and be prepared to adjust your app accordingly.

- Privacy policy and terms of service: Create a comprehensive privacy policy and terms of service that outline your app's data collection, storage, usage, and sharing practices. Clearly communicate these policies to users and ensure they agree to them before using your app.

By following these security and compliance measures, you can build trust with your users and position your personal finance app as a reliable tool for managing their financial life.

Optimizing User Interface and User Experience

Creating a successful personal finance app like Acorns depends on a user-friendly interface and a seamless user experience. In designing an optimal UI/UX for your app, consider the following factors:

Simplicity and ease of use

Make sure your app's interface is clean, organized, and not cluttered with too many complex features. Keeping your app intuitive and straightforward allows users to quickly and easily access the functionality they need.

Intuitive navigation

Design your app with user-friendly navigation that allows users to move throughout the app seamlessly. Use clear labels, logical organization of content, and recognizable icons to make it easy for users to find what they need.

Visual representation of data

Users appreciate visually appealing and easy-to-understand financial data representations. Incorporate charts, graphs, and other visual elements that can help users track their expenses, investments, and financial goals more effectively.

Customization and personalization

Allow users to customize the app to suit their preferences and needs. This may include offering personalized suggestions, customizable dashboard layouts, or the ability to create unique categories for budgeting and expense tracking.

Accessibility

Accessibility is crucial for reaching a wider audience. Make sure your personal finance app is accessible to users with disabilities by following established accessibility guidelines and providing features such as adjustable text sizes and alternative text for images.

Multilingual support

If targeting a global audience, consider offering your app in multiple languages to enhance user experience and reach more potential users.

Testing and Launching Your Personal Finance App

Before launching your personal finance app, it's important to test and validate its functionality thoroughly. Consider the following steps:

Internal Testing

Perform rigorous internal testing with your development team to identify and fix any technical issues or vulnerabilities. Use a combination of manual and automated testing methods, as well as various test scenarios to ensure optimal performance of your app.

Alpha and Beta Testing

Conduct alpha testing with a small group of internal users or team members. This will help identify any issues that might have been missed during the initial internal testing process. Following alpha testing, launch a beta testing phase, inviting a group of users from your target audience to test the app in real-world conditions. Collect feedback from these users to make necessary improvements and enhancements.

Addressing User Feedback and Resolving Issues

Take user feedback from alpha and beta testing seriously, as this will help you perfect your app's features and functions. Address any issues or concerns that arise and ensure they are resolved before launch.

Deciding on a Deployment Method

Once you're confident that your app performs well and meets user expectations, decide on a deployment method. You can choose from cloud-based hosting or on-premise hosting, depending on your preferences and resources.

Launching Your App

After resolving any issues and finalizing your deployment method, it's time to launch your app. Publish your app on popular app marketplaces, such as Google Play and the App Store, and promote it through various channels like social media, email marketing, and content marketing.

Ongoing Maintenance and Support

Launching your app is just the beginning. To ensure long-term success, focus on continuous improvement, and ongoing support. Keep your app updated with new features, security enhancements, and bug fixes, taking into account user feedback and market trends. This will help maintain user satisfaction and encourage growth in user numbers. By following these guidelines and leveraging the power of no-code development platforms like AppMaster.io, you can create an effective personal finance app like Acorns, offering users a user-friendly and comprehensive platform for managing their finances.

FAQ

Acorns offers features such as micro-investing, retirement planning, checking account services, cashback rewards, and financial literacy content.

No-code platforms enable rapid development, cost savings, easy customization, scalability, and elimination of technical debt, all of which can benefit a personal finance app.

Consider adding features such as budget planning, expense tracking, financial goal setting, investment management or recommendations, and financial education resources.

Focus on simplicity, ease of use, intuitive navigation, visual representation of data, and customization to create a user-friendly interface.

Perform rigorous testing, gather user feedback, fix any issues, and choose a suitable deployment method like cloud or on-premise hosting.

Consider using AppMaster.io, a powerful no-code platform that allows you to create web, mobile, and backend applications with ease and great customization options.