Best Mobile Banking Apps of 2024

Discover the top mobile banking apps of 2024 for effortless banking experiences. Compare key features, benefits, and what to consider when choosing the right one for you.

What Is a Mobile Banking App?

A mobile banking app is a software application created by banks and financial institutions to allow customers to manage their accounts, view financial details, and carry out monetary transactions using smartphones or tablets. These apps have revolutionized the way people interact with their banks, offering a more convenient, efficient, and accessible experience for users. Mobile banking apps aim to simplify the banking process and help customers save time and effort by offering a range of features and services that can be easily accessed from anywhere at any time. With the growing popularity of smartphones, banks recognize the need to adapt to customer preferences and integrate technology to better serve their clients.

What Can You Do Through a Banking App?

Mobile banking apps generally provide users with a multitude of features and functionalities, covering most aspects of their financial management needs. Some common capabilities offered by these apps include:

- Account management: Check account balances, view transaction history, and access account statements.

- Funds transfer: Transfer funds between accounts, schedule recurring transfers, and send money to friends or family members.

- Bill payments: Pay bills, schedule future payments, and set up recurring payments.

- Deposit checks: Deposit paper checks by taking a photo of the check using the app's built-in camera functionality.

- ATM locator: Find nearby ATMs and branch locations, often with integrated maps and directions.

- Alerts and notifications: Receive real-time notifications for account activity, set up customized alerts, and monitor account balances.

- Mobile wallets and contactless payments: Use your mobile device for contactless payments at participating retailers and manage mobile wallets such as Apple Pay, Google Pay, or Samsung Pay.

- Customer support: Get help and support through in-app chat, phone, or email services provided by the bank. Apart from the features mentioned above, some banking apps provide advanced options like budgeting tools, investment management, credit score monitoring, and more.

How To Choose an Online Banking App

When selecting a mobile banking app, it's crucial to evaluate various factors to ensure it meets your needs and provides a seamless banking experience. Here are some points worth considering when choosing an online banking app:

- Availability of features: Identify the features you require in a banking app and make sure the app you choose offers them. It could include bill payments, funds transfers, check deposits, or other services.

- Ease of use: A user-friendly interface with straightforward navigation is vital for ensuring a smooth and effortless experience.

- Security: Security is a top concern for most users. Make sure the app you choose has stringent security measures, such as multi-factor authentication, encryption, and biometric authorization.

- Compatibility: Verify that the mobile banking app is compatible with your smartphone or tablet and works seamlessly with your device's operating system.

- Customer support: Look for apps that offer robust customer support to assist you in case of any issues or queries related to your account or transactions.

- Bank reputation: Choose a mobile banking app from a reputable bank with a history of trust and reliability, ensuring your financial transactions and personal information are in good hands. After closely considering these factors, you can make an informed decision while selecting a mobile banking app that caters to your specific requirements and offers a hassle-free banking experience.

Best Mobile Banking Apps of 2024

With consumers increasingly relying on smartphones and tablets for various activities, mobile banking apps have become an essential tool in managing personal finances. As competition grows between banks, institutions are investing more and more in developing cutting-edge apps that offer exceptional user experience and security. In this section, we will take a closer look at some of the best mobile banking apps of 2024, focusing on their usability, features, and benefits. Whether you're an existing customer of these banks, or you're considering switching, understanding the advantages of these top apps will help you make an informed decision.

Citi Mobile

Citibank's Citi Mobile app is user-friendly, feature-rich, and designed to help customers manage their finances with ease. With Citi Mobile, you can access various banking services, including checking account balances, viewing transaction history, paying bills, and transferring funds. Some of the standout features of Citi Mobile include:

- Snapshot: This feature allows you to view your account balances and recent transactions without logging into the app. It provides a quick and easy way to assess your financial standing at a glance.

- P2P Payments: Citi Mobile enables customers to send money to friends or family instantly using Zelle, a person-to-person (P2P) money transfer service. With just an email address or mobile number, you can safely send or request money within minutes.

- Mobile check deposit: This feature allows you to easily deposit checks using your smartphone's camera. Just take a photo of the check, and the app will facilitate the rest of the process.

- Customizable notifications: Citi Mobile allows you to set up personalized alerts to stay informed about your account activity, including balance updates, scheduled payments, and transaction notifications.

- Contactless payments: The app supports Citi Pay, a mobile wallet that lets you make contactless payments using your smartphone, making transactions more convenient and secure. Overall, Citi Mobile is a highly-functional, secure, and intuitive app that meets the needs of a wide range of customers. Its user-centric design and features set it apart, making it one of the best mobile banking apps of 2024.

Bank of America Mobile Banking

Bank of America's Mobile Banking app ranks highly among users due to its wide array of banking features and seamless user experience. Whether you need to check your account balances, pay bills, or locate an ATM, the Bank of America Mobile Banking app has you covered. Key features of Bank of America Mobile Banking include:

- BankAmeriDeals: This app-exclusive feature delivers cashback deals on popular brands, tailored to your spending habits. Once you activate a deal, simply use your Bank of America credit or debit card, and the cashback will be directly credited to your account.

- Cardless ATM access: The app lets you access Bank of America ATMs without needing to carry your physical card. Simply open the app, tap on the mobile wallet, and use the generated code for secure cash withdrawals.

- Bill Pay: With the Bank of America Mobile Banking app, you can pay your bills on time, ensuring you stay on top of your finances without having to write checks or visit multiple service providers.

- Mobile check deposit: Deposit checks from your smartphone by taking a photo of the front and back of the check. This feature makes it easy to add funds to your account without visiting a bank location.

- Erica virtual assistant: Bank of America's AI-powered virtual assistant, Erica, is fully integrated into the app. This chatbot helps customers easily access information on their accounts, make transactions, and receive personalized financial guidance. Impressively, the Bank of America Mobile Banking app combines a straightforward interface with an extensive suite of features. This combination has earned it a spot among the best mobile banking apps of 2024.

Chase Mobile

Chase Mobile is the mobile banking app developed by JPMorgan Chase, one of the largest banks in the United States. The app offers a range of banking and financial management features that make it easy for you to access your account, track your spending, manage your budget, and launch transactions at your fingertips. Here are some of its standout features:

- Account Management and Monitoring: The app allows users to check account balances, view detailed transaction history, and monitor spending. With Chase Mobile, you can set up personalized account alerts that notify you when specific events occur, like when a large purchase is made or when an account balance falls below a certain threshold.

- Transfers, Bill Payments, and Mobile Check Deposit: Chase Mobile enables users to transfer funds between their Chase accounts, set up automatic transfers, and send money to friends and family using Chase QuickPay with Zelle. You can also pay your bills using the app's integrated bill payment functionalities, and deposit checks remotely by snapping a photo of the check, without having to visit a physical branch or ATM.

- Integration with Third-Party Apps: The app integrates with popular third-party apps for budgeting and investing, making it more convenient for users to track their money and develop a holistic financial overview. For instance, you can sync Chase Mobile with apps like Mint and Quicken to monitor your spending and set budgets for various categories of expenses.

- Enhanced Security Measures: Chase Mobile employs a variety of security measures to protect users' account information and prevent unauthorized access. Some of these measures include biometric authentication (like fingerprint, facial recognition, or voice recognition), real-time fraud monitoring, and the option to lock or unlock your cards instantly. The app also allows users to set up custom account activity alerts, ensuring they are aware of any unusual or suspicious transactions.

Ally: Banking & Investing

The Ally: Banking & Investing app, offered by Ally Bank, is a robust and user-friendly mobile banking app that combines traditional banking tasks with investment options. While many mobile banking apps focus solely on banking services, Ally encompasses both areas of personal finance, providing users with a comprehensive suite of tools for managing their money. Key features include:

- Efficient Account Management: Using Ally: Banking & Investing, you can view your account balances and activity, deposit checks, transfer money between accounts, and pay bills. Additionally, the app offers a set of budgeting tools for tracking your spending and developing personalized savings goals.

- Investing with Ally: With a single account, you can gain access to Ally's investment platform. From there, you can trade a variety of investment products, including stocks, exchange-traded funds (ETFs), and mutual funds. You can also use Ally Invest tools for researching investments, tracking market news, and developing personalized trading strategies based on your financial goals and risk tolerance.

- Self-Directed Trading and Managed Portfolios: Ally offers two approaches to investing: self-directed trading and managed portfolios. With self-directed trading, you can control your own investment decisions, selecting and managing your investments individually. With managed portfolios, you'll answer questions regarding your investment goals, risk tolerance, and timeline, allowing Ally to recommend a diversified portfolio based on those answers. Ally's managed portfolios are composed of low-cost, index-tracking ETFs, providing you with a cost-efficient and passive investment strategy.

- Customer Support: Ally is known for its robust customer support, offering round-the-clock assistance via phone, chat, and email. This ensures that users have access to help should they encounter any issues or have questions about their banking or investing activities.

Discover Mobile

The Discover Mobile app is designed for Discover Bank customers, allowing them to easily manage both their deposit accounts and credit cards from a unified platform. The app is user-friendly and robust, offering a wide range of features that help users stay on top of their finances. Some key features include:

Account Management and Tracking: Access your account information, monitor your spending, and view transaction history all in one place. You can also set custom alerts that notify you of account activity, such as low balances or large purchases.

Bill Pay and Transfer Features: Discover Mobile enables you to pay bills and transfer funds between accounts, all from the convenience of your smartphone or tablet. Additionally, the app offers mobile check deposit functionality, allowing you to deposit paper checks simply by snapping a photo.

Credit Card Management: For credit card users, the app provides features like viewing and managing your balance, tracking your FICO credit score, setting up automatic payments, and redeeming your cashback rewards. You can also request replacement cards or report lost or stolen cards directly from the app, streamlining the process and ensuring prompt action is taken.

Security and Fraud Protection: The Discover Mobile app employs advanced security measures to protect your account information and ensure that your financial transactions are safe. These measures include biometric authentication (fingerprint or facial recognition), as well as the option to freeze your card if you suspect any unauthorized usage, and receive instant notifications for any suspicious activity.

Wells Fargo app

The Wells Fargo app is a mobile banking application created by Wells Fargo, one of the largest banks in the United States. This app offers its users a seamless banking experience, featuring a simple interface and a comprehensive range of tools designed to manage personal finances with ease. Some key features of the Wells Fargo app include:

- Account management: Users can conveniently access their account information, check account balance, view transaction details, and track spending patterns.

- Bill pay: The app lets you schedule bill payments, manage one-time or recurring payments, and even receive eBills from participating companies.

- Transfer and receive money: Send and receive money using Zelle®, a service incorporated into the app for quick and effortless transactions.

- Mobile deposit: Deposit checks by simply taking a photo of the front and back of the endorsed check.

- ATM and branch locator: Easily locate nearby Wells Fargo ATMs and branches using the app's map feature.

- Security: The Wells Fargo app employs robust security measures, including biometric authentication and two-step verification, to safeguard users' information and transactions.

- Investment tools: The app also integrates with Wells Fargo Advisors, the bank's investment management platform, providing users with access to trading tools and market insights.

The Wells Fargo app is available for both Android and iOS devices, offering comprehensive financial management features optimized for a mobile-centric user experience.

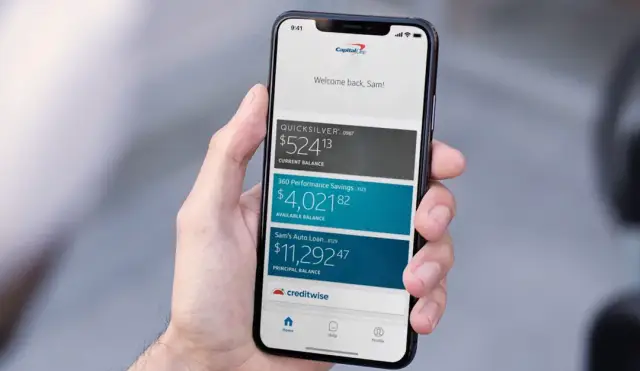

Capital One app

The Capital One app is a versatile mobile banking solution designed by Capital One, a well-known financial institution in the US. The app aims to provide users with a user-friendly platform for managing their bank accounts, credit cards, and loans in a single application. The Capital One app sports several useful features, such as:

- Account management: Effortlessly review account balances, transaction history, and manage multiple banking accounts and credit cards.

- Instant purchase notifications: Stay informed of your purchases and get real-time notifications when your Capital One credit card is used.

- Bill pay: Pay bills directly through the app, set up automatic payments, and stay on top of your financial responsibilities.

- Transfer funds: Easily move money between Capital One accounts or external bank accounts.

- Creditwise®: Monitor your credit score and receive personalized insights to help improve it, all within the app.

- Security features: The Capital One app employs advanced security measures, such as TouchID and FaceID authentication for iPhones, to protect user data and transactions.

The Capital One app is available for both Android and iOS devices and frequently receives updates to improve performance and user experience.

U.S. Bank app

The U.S. Bank app is a mobile banking application designed for customers of U.S. Bank, the fifth-largest commercial bank in the United States. This powerful app provides users with the tools to manage their finances effectively from the convenience of their smartphones. Key features of the U.S. Bank app include:

- Account management: View account balances and transaction history and set up customized account alerts to stay informed about your finances.

- Bill pay & transfers: Pay bills, schedule one-time or recurring payments, and transfer funds between U.S. Bank accounts or external accounts.

- Mobile check deposit: Capture images of endorsed checks to deposit them directly into your account.

- Zelle® integration: Send and receive money using Zelle®, a fast and secure transaction service well-suited for person-to-person payments.

- ATM and branch finder: Locate nearest U.S. Bank ATMs and branches with ease, wherever you may be.

- Touch ID® and Face ID® authentication: Ensure the safety of your account with added biometric authentication features on compatible devices.

The U.S. Bank app is available for download on Android and iOS devices, delivering a comprehensive mobile banking experience tailored for both smartphones and tablets.

In Conclusion

With the ever-evolving industry of mobile technology and financial services, the best mobile banking apps of 2024 have made it easier and more efficient for users to manage their finances on the go. By offering a diverse array of useful features and enhanced security measures, these mobile banking apps cater to a broad range of user requirements, ensuring that banking remains convenient and accessible in today's fast-paced digital world.

FAQ

A mobile banking app is a software application created by banks and financial institutions to help customers manage their accounts, view financial details, and carry out monetary transactions using smartphones or tablets.

Mobile banking apps generally allow users to check account balances, view transaction history, transfer funds between accounts, pay bills, deposit checks, find nearby ATMs, set up alerts and notifications, and use mobile wallets for contactless payments.

When choosing a mobile banking app, consider factors like ease of use, availability of features that meet your banking needs, security measures, customer support, and compatibility with your smartphone or tablet.

Mobile banking is gaining popularity due to the convenience and ease it offers to customers. It allows users to perform most of their banking tasks from anywhere, anytime, eliminating the need to make trips to a physical bank location.

Citi Mobile is a mobile banking app from Citibank that offers users a range of financial management features like account balance checking, transaction history, bill payments, fund transfers, and customizable alerts.

Bank of America Mobile Banking is an app designed by Bank of America that provides users access to their accounts, allowing them to monitor transactions, pay bills, deposit checks, transfer funds, and find ATMs or financial centers.

Chase Mobile, developed by JPMorgan Chase, offers a range of features similar to other banking apps but distinguishes itself by offering enhanced security features, a dashboard with personalized insights, and integration with popular third-party apps for budgeting and investing.

Ally: Banking & Investing, provided by Ally Bank, combines both traditional banking features and investment options in one app. Users can perform regular banking tasks while also having access to trading stocks, ETFs, and mutual funds, as well as receiving personalized financial advice.

Yes, Discover Mobile is an app designed for Discover Bank customers, which includes services for both their deposit accounts and credit cards. Users can manage their credit card payments, redeem rewards, and track their credit scores through the app.

The Wells Fargo app is a mobile banking app created by Wells Fargo for its customers, offering account management, bill pay, deposit checks, and various other financial features. The app also includes investment tools and access to their investment management platform.