Navigating Financial Markets with Low-Code AI

Explore the potential of low-code AI to transform your financial market analysis and investment strategies. Learn how a no-code platform like AppMaster can be instrumental in your financial journey.

Understanding Low-Code AI in Financial Markets

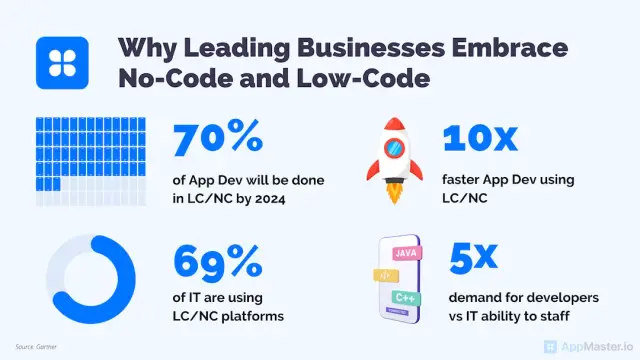

As the financial markets grow increasingly complex, professionals are turning to innovative technologies to gain an edge. One of the most impactful technologies emerging in this sector is Artificial Intelligence (AI), which has the potential to revolutionize the way financial data is analyzed and handled. Despite its vast capabilities, building AI systems traditionally required extensive coding expertise, which was a barrier to many finance professionals who may not have advanced programming skills. This is where low-code AI becomes a game-changer.

A low-code approach to AI empowers users to rapidly develop and deploy machine learning models and AI-driven applications with less technical know-how. This democratization of technology opens new vistas for a broad range of financial market applications including algorithmic trading, fraud detection, risk management, and customer service improvements.

Low-code AI offers a simplified coding experience and accelerates the workflow from the conception of a model to its deployment. It encapsulates complex programming into visual blocks or modules that can be arranged to create powerful AI algorithms. Users can drag and drop these pre-built components to formulate workflows that reflect sophisticated AI functionalities.

This visual development interface significantly reduces the development time and costs associated with traditional AI applications. These platforms often come with connectors or integrations, allowing easy access to financial databases, APIs, and other essential tools in the financial ecosystem. This seamless integration facilitates rapid testing and iteration, essential in the fast-moving financial markets where opportunities come and go in the blink of an eye.

Moreover, low-code AI tools also have features that ensure governance and compliance with the financial industry's regulatory requirements. This is pivotal in maintaining trust and legality in the deployment of AI-powered financial instruments.

For the finance community, this means wider accessibility to AI technology which can be leveraged for predictive analytics, customer segmentation, and even real-time market trend analysis. Enhanced predictive models can accurately forecast market movements, leading to better investment decisions and risk management policies. These potential applications of low-code AI can transform financial analysis and strategy formulation.

It is imperative to highlight that low-code does not mean 'no expertise required at all'. Financial markets are complex, and AI models must be developed with a clear understanding of data and underlying financial cognitive frameworks. Creating reliable AI solutions still requires a nuanced understanding of the financial domain alongside a strategic approach to data analytics offered by low-code tools.

This amalgamation of domain knowledge and tech capacity is where platforms like AppMaster come into the picture. They allow finance professionals to design, tweak, and deploy AI models without zeroing in on the nitty-gritty of code but rather focusing on market understanding and strategic foresight.

Low-code AI in the financial markets bridges elaborate computational technologies and financial expertise. By leveraging these tools, financial professionals can enhance their data-driven decision-making, cater to personalized client needs, and navigate the volatile market with technology at their fingertips, all while staying abreast of compliance and governance.

Benefits of Low-Code AI for Finance Professionals

Financial professionals often operate in a world where speed and accuracy are paramount. Technology advancements have given the finance industry tools to enhance decision-making, streamline operations, and personalize client interactions. Among these technological innovations, low-code AI platforms have become particularly valuable for finance professionals. Utilizing these platforms can yield many significant benefits:

- Accelerated Development and Deployment: With low-code AI platforms, the time to develop, test, and deploy predictive models and analytics tools is reduced significantly. This rapid pace allows financial institutions to respond swiftly to market changes and client needs.

- Accessibility for Non-Technical Staff: Low-code platforms enable professionals without a technical background to contribute to developing and modifying AI models. This democratization of AI empowers a wider range of staff to innovate and drive progress.

- Cost-Effectiveness: Low-code AI solutions can save on labor costs by reducing the need for a large team of specialized data scientists and developers. They often require less investment in infrastructure and maintenance, which further drives down expenses.

- Agility in Model Refinement: Financial markets are volatile and conditions can change rapidly. Low-code AI tools offer the flexibility to quickly adjust models responding to new data, regulations, or market trends.

- Enhanced Data Analysis: By integrating disparate data sources, low-code AI can provide a holistic view of market conditions, client portfolios, or risk factors, enabling more comprehensive analysis and better-informed decision-making.

- Improved Risk Management: AI is well-suited to identifying patterns that may signal potential risks. Low-code platforms make developing and deploying models that monitor and predict these risks easier, aiding in the mitigation process.

- Customization and Scalability: As the needs of a financial organization evolve, low-code AI platforms offer the ability to customize applications and scale solutions to meet growing demands without a proportional increase in resources or complexity.

- Compliance and Security: Financial institutions are bound by stringent regulatory requirements. Low-code AI platforms can assist in ensuring that data handling and processing comply with these regulations, while keeping security at the forefront.

Platforms such as AppMaster are designed to facilitate these benefits for anyone looking to tap into the potential of low-code AI in the financial industry. Not only does such a platform accelerate development and reduce costs, but it also aligns with the need for rigorous compliance and security standards that are paramount in finance.

AppMaster allows finance professionals to leverage high-level technological capabilities in their work by creating tailor-made algorithms for market predictions or fraud detection. Its accessible user interface and powerful backend mean that creating applications and AI-driven solutions is now within reach of finance experts without deep programming skills.

Low-code AI platforms are redefining what is possible in the finance sector by offering a convergence of user-friendliness, efficiency, and advanced technology to cater to an ever-evolving financial world.

Key Features of Low-Code AI Platforms for Financial Analysis

Low-code AI platforms are revolutionizing how financial analysts and institutions operate by offering powerful and user-friendly tools to process vast amounts of data, identify trends, and predict market movements. At the heart of this transformation is the seamless integration of AI capabilities with financial analysis workflows that traditionally required extensive coding knowledge. Here are some of the key features that make low-code AI platforms indispensable for finance professionals.

- Intuitive Drag-and-Drop Interfaces: A primary feature of low-code AI platforms is their ability to provide an intuitive, visual interface where users can build models by simply dragging and dropping components. This significantly reduces development time and makes AI accessible to analysts without advanced programming skills.

- Pre-built Templates and Components: These platforms typically have a library of pre-built models, templates, and components specifically tailored for financial tasks such as time series forecasting, fraud detection, and customer segmentation. These building blocks can be customized and combined to create complex models suited to particular financial analysis needs.

- Data Integration Capabilities: Low-code platforms offer powerful tools for integrating with various data sources, be it traditional databases, real-time market feeds, or unstructured data sets. Harnessing this data effectively is essential for conducting accurate financial analysis, and these platforms enable this integration without complex coding.

- Automated Data Processing: Financial data is often messy and requires significant preprocessing. Low-code AI platforms offer automated tools for cleaning, normalizing, and transforming data so it is ready for analysis, thus saving valuable time and reducing errors.

- Machine Learning Model Training: With these platforms, users can train machine learning models tailored to their data sets. This could involve predictive analysis, pattern recognition, or risk assessment models that learn from historical trends and can forecast future market conditions.

- Real-Time Analytics: The speed of financial markets demands real-time data analysis. Low-code AI platforms enable the development of applications that process and analyze data in real-time, allowing financial professionals to react promptly to market changes.

- Advanced Algorithms: Even without extensive coding knowledge, users can access sophisticated algorithms for complex analyses such as sentiment analysis, algorithmic trading, and risk management simulations, which are crucial for informed financial decision-making.

- Scalability: As financial institutions manage large and ever-growing data volumes, the scalability of these tools becomes critical. Low-code AI platforms can efficiently scale with the growth of data and computational requirements.

- Compliance and Security: Financial data is sensitive and subject to regulatory compliance. Low-code platforms prioritize data security and ensure that applications comply with industry regulations like GDPR, HIPAA, or GLBA, often with audit trails and built-in governance mechanisms.

- Collaboration: These platforms foster collaboration between different stakeholders, such as data scientists, analysts, and IT teams. They enable the sharing and iterative refinement of financial models while maintaining control over access and permissions.

Utilizing a powerful no-code platform like AppMaster can significantly enhance a financial firm’s ability to implement low-code AI. AppMaster provides an ecosystem where financial models can be created, tested, and deployed with ease, offering an array of features that are tailored for the high demands of the industry. This enables finance professionals to focus on strategy and analysis rather than the nuances of programming, leading to more agile and effective financial market operations.

Building AI Models with Low-Code Tools

AI has revolutionized numerous industries, and financial markets are no exception. AI models are at the forefront of aiding investors, analysts, and financial institutions in making strategic decisions. Traditional AI development, yet, has been the purview of data scientists and coders — until now. Low-code tools have democratized the process, allowing non-technical professionals to construct complex AI models that can analyze trends, predict market movements, and offer personalized finance advice.

Low-code platforms facilitate building AI models through intuitive user interfaces, offering various components and modules that can be pieced together to form complex algorithms. Below is a step-by-step process to leveraging low-code tools for constructing AI models in the financial sector.

Understanding the Basics of Your Financial Model

Before constructing the AI model, one must comprehend the financial model it seeks to enhance or replicate. This could be anything from a risk assessment algorithm to a predictive model for stock performance. The goals should be clearly defined to ensure that the low-code AI model aligns with the intended outcomes.

Selecting the Right Low-Code Platform

Choosing a suitable low-code platform is crucial. It should be powerful enough to handle the sophistication required for financial applications. Platforms like AppMaster offer a conducive environment with pre-built templates, drag-and-drop functionalities, and extensive customization options to cater to the nuanced needs of financial modeling.

Designing the AI Model

Once a low-code platform has been selected, one can design the AI model. Most low-code platforms provide a graphical interface where users can assemble the logical flow of the model. This involves defining data sources, setting up processing scripts (like machine learning algorithms), and structuring the output. Users can sometimes harness existing machine learning models and customize them as per their needs.

Integrating Data Sources

Financial AI models are data-driven, hence integrating reliable data sources is paramount. Low-code platforms often provide connectors to various databases and financial APIs. This ease of connection ensures a seamless flow of real-time data, which is essential for relevant and timely financial forecasting.

Testing and Iterating the Model

Testing is a vital part of AI model development. Low-code tools allow for quick and efficient testing of algorithms. Users can monitor the model's performance and adjust as needed without delving into complex code. This iterative process can significantly shorten development cycles and enhance the model's accuracy.

Deployment and Integration

Deploying AI models built with low-code tools is straightforward, as many platforms handle the heavy lifting of server provisioning and software compatibility. Once the AI model is ready, it can be integrated into existing financial systems or used to build new financial applications. The focus on compatibility with existing IT infrastructures is especially useful for financial institutions looking to modernize without overhauling their established systems.

Building AI models with low-code tools is a game-changer for the financial industry. It empowers financial experts with limited coding expertise to contribute actively to the AI revolution. Moreover, platforms like AppMaster are leading this transformation by offering no-code solutions that streamline the creation and deployment of AI models, further simplifying the journey from concept to execution in the world of finance.

Case Studies: Low-Code AI Success in Financial Markets

Industry professionals have long recognized the critical role of AI in the financial sector, especially regarding market predictions, risk assessment, and customer relationship management. Yet, deploying AI in this sector traditionally required significant technical expertise and extensive resource allocation.

The advent of low-code AI platforms has dramatically altered this environment, providing a nimble and efficient means for financial services to harness the power of AI. Here, we highlight a few case studies demonstrating low-code AI's success in transforming financial market operations.

Real-Time Stock Market Analysis

In an investment firm seeking to capitalize on short-term market movements, the rapid analysis of stock trends is imperative. Utilizing a low-code AI platform, the firm developed a model aggregating real-time market data, social media sentiment, and historical trends to predict stock movements. The platform's inherent speed in model deployment allowed the firm to stay ahead of market changes, optimizing its investment strategies and maximizing profits while reducing time-to-market for their analysis tools.

Fraud Detection Enhancement

Financial institutions are at constant risk from fraudulent activities. A regional bank utilized low-code AI to enhance its fraud detection system. Leveraging the platform's pre-built machine learning modules, the bank implemented an advanced anomaly detection system capable of identifying potential fraud with greater accuracy and speed. As a result, the bank saw a significant reduction in fraudulent transactions, alongside an improved customer trust.

Personalized Banking Experience

Customer experience can be a competitive differentiator for banks. A multinational bank used a low-code platform to create an AI-driven personalized recommendations engine. The bank could provide individualized financial advice and product offerings by analyzing transaction histories and behavior patterns. This improved the customer experience and resulted in higher conversion rates for the bank's financial products.

Compliance and Reporting Efficiency

In the financial industry, compliance with regulations such as Know Your Customer (KYC) and Anti-Money Laundering (AML) is not optional. A fintech startup leveraged low-code AI to streamline its compliance processes. The solution automated the data collection and analysis required for regulatory reporting, reducing errors and saving countless hours of manual review. This also allowed the startup to scale rapidly without a corresponding increase in compliance staff.

Accelerated Loan Decision Process

A loan provider utilized low-code AI to revamp its loan approval process. By integrating a predictive model that assesses credit risk based on a variety of factors including credit score, income, and employment history, the provider was able to make quicker and more accurate loan decisions. The agility offered by the low-code platform allowed for rapid iteration and model improvement, leading to increased loan processing efficiency and customer satisfaction.

These case studies exemplify just a few of the success stories in the financial sector. Low-code AI platforms like AppMaster can be pivotal in achieving such success. AppMaster's no-code tools enable financial organizations to develop AI solutions swiftly and with less expertise than traditional programming methods. With its visual programming interface, users can drag-and-drop components to build complex AI-driven analytical tools and applications suited to their specific needs in the financial markets.

Evaluating the Risks and Challenges of Low-Code AI

The advent of low-code AI platforms has opened the gates to sophisticated financial market analysis for a broader range of users, including those with limited coding skills. Yet, alongside the numerous benefits such technologies bring, it is essential to acknowledge and evaluate the associated risks and challenges that finance professionals might encounter. As we traverse this promising terrain, we must recognize potential pitfalls to ensure secure, reliable, and ethical AI deployment in financial markets.

Dependency on Automated Decision-Making

One of the central challenges lies in the increased dependency on automated systems that low-code AI might facilitate. While automating tedious tasks can significantly boost efficiency, over-reliance on AI could compromise human oversight, leading to errors or overfit models skewing financial decisions.

Data Privacy and Security Concerns

Low-code platforms can handle vast amounts of sensitive financial data. Consequently, ensuring the privacy and security of this data becomes a key concern. Users must diligently vet the security protocols of low-code platforms and consider encryption, secure access controls, and compliance with data protection laws such as GDPR or HIPAA, where applicable.

Integration and Interoperability Challenges

Finance professionals often work with an ecosystem of tools and legacy systems. Integrating AI models developed on low-code platforms into these existing systems can be challenging. Ensuring that the AI components can communicate effectively with other parts of the financial infrastructure often requires additional coding, potentially negating some of the low-code benefits.

Ensuring Regulatory Compliance

Financial markets are heavily regulated. AI systems must adhere to a complex web of regulations — and this needs due diligence from the low-code platform providers and the end-users. Complying with regulations such as the Dodd-Frank Act or the Basel Accords when developing AI solutions on low-code platforms can be daunting, especially for those unfamiliar with the legal intricacies.

Limited Customization and Control

While low-code AI platforms offer simplicity and efficiency, they sometimes restrict the level of customization and granular control over the AI models. Finance professionals with specific, nuanced requirements might find these limitations constraining.

Model Interpretability and Explainability

The simplicity of low-code platforms often comes at the cost of interpretability. AI solutions used for financial applications must be accurate and understandable. Stakeholders may need to explain how decisions were made, especially in high-stakes scenarios. Low-code solutions may not always provide the full transparency needed for such explainability, impacting trust and adherence to AI ethics guidelines.

Ensuring Model Accuracy and Reliability

Low-code AI platforms simplify the model-building process, but they also need to ensure the reliability and accuracy of these models. Financial markets are dynamic and unpredictable, and without the right expertise, there's a risk of building models that are not fitting for the task, potentially leading to poor investment decisions.

Scaling and Performance Constraints

As the demand for AI-driven financial analysis grows, scalability becomes a pressing issue. Low-code AI solutions must be capable of scaling to meet the workload demand without performance degradation. Furthermore, they must maintain quick and efficient operations even when processing large volumes of data in real time, a common requirement in the financial sector.

In closing, while low-code AI presents transformative possibilities for the finance industry, it is accompanied by risks and challenges that must be understood and navigated carefully. Finance professionals should approach low-code AI with a balanced perspective, taking advantage of its capabilities while mitigating its shortcomings. For practitioners deciding on a platform like AppMaster, a thorough assessment is advisable to confirm that these challenges are addressed, thereby securing a reliable foundation for AI-driven financial market participation.

Future of Financial Markets With Low-Code AI Technology

The current trajectory of financial technology indicates a future where AI is ubiquitous, transforming how we do business in the financial markets. Low-code platforms are at the forefront of this revolution, democratizing access to sophisticated AI tools that once required extensive programming knowledge and resources. Let's explore the prospective shifts and improvements low-code AI technology is expected to bring to the financial sector.

The future of financial markets with low-code AI technology may unfold in several revolutionary ways:

Greater Access to Complex Trading Algorithms

Low-code platforms will continue to make it easier for traders and investors to design and deploy complex trading algorithms. Individuals will be capable of personalizing these algorithms to fit specific trading strategies, all without needing to understand the deep intricacies of coding or the underlying AI technology.

Enhanced Predictive Analytics and Decision Making

Low-code tools will offer enhanced predictive analytics capabilities as they become smarter and more intuitive. Platforms will leverage vast historical data repositories and real-time inputs, enabling users to forecast market trends and make more informed investment decisions more accurately.

Automation of Regulatory Compliance

The regulatory environment in finance is stringent and constantly evolving. Low-code AI will play a key role in automating compliance tasks, such as tracking and reporting, saving significant amounts of time and reducing the likelihood of human error that can result in hefty fines.

Improved Risk Management

Risk management is vital in the volatile world of finance. The future will see low-code AI advancements that offer more nuanced risk assessment tools. These will allow for real-time analysis and proactive risk mitigation, catering to the diverse risk appetites of market participants.

Custom Financial Products

Innovative financial products and services tailored to the unique needs of niches or individual customers can be crafted through low-code AI. This personalized approach, supported by AI-driven insights, will potentially reshape customer experience and service delivery.

Intelligent Automation of Routine Tasks

Low-code AI technology will advance the automation of routine and mundane tasks even further. From client onboarding to transaction processing, these platforms will offer tools enabling businesses to automate workflows efficiently, ensuring staff can focus on more strategic initiatives.

Real-Time Analytics and Reporting

Due to low-code AI platforms, the capability to perform real-time analytics and generate reports instantly will become a standard expectation. Financial institutions will be able to react swiftly to market changes, providing them an edge over competitors still bound by traditional, slower analytical methods.

Interoperability and Integration

The ability of low-code AI systems to seamlessly integrate with many financial tools and platforms will streamline operations like never before. This interconnectedness will optimize data flow and facilitate novel strategies that capitalize on diverse datasets and systems.

Greater Emphasis on AI Ethics and Bias Reduction

As AI becomes more integrated into financial systems, there will be a greater emphasis on ethical AI training, usage, and bias reduction. Low-code platforms will likely incorporate features that help model builders consider these aspects, promoting fairness and ethical practices within financial markets.

Platforms such as AppMaster, with their flexible and powerful no-code solutions, will become pivotal in navigating this AI-driven era in financial markets. AppMaster can play a significant role in empowering businesses and entrepreneurs to unlock the full potential of low-code AI by offering a comprehensive environment for constructing web, mobile, and backend applications. With each advancement, these developments promise a future where market agility, accuracy, efficiency, and inclusivity are not just goals but daily realities for finance professionals worldwide.

Getting Started with Low-Code AI in Finance Using AppMaster

With the continuous evolution of financial technology, organizations seek ways to leverage AI to enhance their financial operations without getting entangled in complex coding. This is where low-code platforms shine, meticulously bridging the gap between advanced technology and its accessible deployment. AppMaster, a powerful no-code environment, stands out as an intuitive tool for finance professionals aiming to harness AI's full potential. Here's a guide on how to get started with low-code AI in finance using AppMaster.

- Step 1: Define Your Financial Use Case: Before diving into the AppMaster platform, you must clearly define the financial problem you want to solve or the process you wish to improve using AI. This could vary from predicting stock market trends to detecting fraudulent transactions or optimizing investment portfolios. A clear objective lets you focus on what you want to achieve and tailor your AI model accordingly.

- Step 2: Familiarize Yourself with the AppMaster Platform: Create a free account to explore the platform's capabilities. The AppMaster environment is designed for a streamlined user experience, which lets you visually create data models, establish business logic, and manage API endpoints without writing a single line of code.

- Step 3: Model Your Data: Utilize AppMaster's visual tools to construct data models that reflect financial entities and relationships. You can effortlessly outline the schema for stocks, transactions, user profiles, or any other data relevant to your use case.

- Step 4: Create Business Processes: Design your financial AI business logic by setting up Business Processes (BPs) through AppMaster's visual BP Designer. These processes will govern how your application responds to market data, triggers events, and executes decisions autonomously

- Step 5: Deploy AI Capabilities: With your data and business logic in place, it's time to incorporate AI into your low-code application. Although AppMaster is primarily a no-code platform, you can integrate externally developed AI models or third-party AI services through comprehensive API integrations.

- Step 6: Test and Iterate: Testing is a crucial phase in any development process. In financial markets, where accuracy is paramount, ensure that your AI models work as intended within the application. Utilize the swift regeneration and deployment features of AppMaster to fine-tune your AI implementation.

- Step 7: Monitor and Refine: Continuous monitoring is key once your application is live. Financial markets are dynamic, and your AI models should adapt to new patterns and evolutionary trends. Leverage AppMaster's adaptability to refine your financial AI application over time, ensuring it remains relevant and effective.

Conclusion

Taking the first step into low-code AI within the financial sector can seem challenging, but AppMaster simplifies the transition. By providing a seamless, no-code construction of AI-infused applications, finance professionals can stay ahead of the curve, adapting to market changes with agility and insight. Whether you're a small fintech startup or a large financial institution, AppMaster empowers you to deploy AI-driven solutions efficiently, future-proofing your financial strategies.

FAQ

Low-code AI refers to the use of platforms that allow users to build and deploy artificial intelligence models with minimal coding, often through visual interfaces and drag-and-drop components.

Low-code AI can impact financial markets by enabling quick and efficient development of algorithms for market analysis, risk assessment, and investment strategy optimization, leading to more informed decision-making.

The benefits include rapid development and deployment of models, cost-effectiveness, accessibility for non-technical users, and the ability to quickly adapt to changing market conditions.

Yes, low-code AI platforms are designed to be user-friendly and accessible to individuals with minimal or no coding experience, thanks to their intuitive visual interfaces.

With low-code tools, you can build a variety of AI models for financial analysis such as predictive models for stock prices, algorithms for fraud detection, and systems for customer behavior analysis.

Yes, many businesses and finance professionals have successfully implemented low-code AI to improve their operations, from enhancing stock market predictions to automating risk management processes.

Risks may include overreliance on automated systems, data privacy concerns, model interpretability, and the need to ensure that the AI systems comply with financial regulations.

AppMaster simplifies the process by providing a no-code platform where users can build complex AI models and applications for financial markets using visual programming and pre-built components without writing code.

Yes, AI models built with low-code platforms can typically be integrated with existing financial systems through APIs or other interoperability mechanisms.

Low-code platforms usually provide built-in security features and comply with industry standards to protect data confidentiality and ensure secure operations within financial applications.

Expected trends include the increased adoption of low-code AI for real-time analytics, custom financial instruments creation, and the usage of AI for regulatory compliance and fraud prevention.