Managing Cash Flow and Financial Planning for Startups

Discover effective strategies and tools for managing cash flow and financial planning in startups. Learn how to achieve financial stability, boost growth, and attract investors.

Startups are known for their innovative ideas and rapid growth potential. However, managing the financial side of their business is often overlooked, causing many promising startups to fail. Proper financial planning and cash flow management are crucial for a startup's success, as it helps establish financial stability and provides a strong foundation for growth.

In this article, we will discuss the importance of financial planning for startups and explore strategies to manage cash flow effectively. By implementing these strategies, startups can achieve financial stability, boost growth, and attract the necessary investment to support their business ventures.

Importance of Financial Planning for Startups

Financial planning is the process of setting financial goals and developing a strategy to achieve those goals. For startups, financial planning involves allocating resources, controlling expenses, and ensuring that their business operations are financially sustainable. Here are some reasons why financial planning is essential for startups:

- Resource Allocation: Efficient resource allocation is critical for startups, as it helps them prioritize their needs and invest in the areas that will have the most significant impact on their growth. Financial planning helps startups determine where to invest their limited resources and make the most of their available funds.

- Expense Control: Startups often operate on tight budgets, which makes controlling expenses essential. Financial planning helps startups identify areas where they can cut costs, and it aids in finding more efficient ways to manage their funds.

- Predicting Cash Flow Needs: Being able to predict when and how much cash will flow in and out of a business is vital for maintaining financial stability. Financial planning enables startups to forecast their cash flow needs and make adjustments to their spending and expenses as needed.

- Mitigating Financial Risks: Startups face numerous financial risks, such as market fluctuations, changing consumer preferences, and increasing competition. Financial planning helps startups identify potential financial risks and develop strategies to mitigate their impact.

- Attracting Investors: Investors are more likely to invest in startups with a comprehensive financial plan, as it demonstrates that the startup has a clear vision for its future growth and profitability. Financial planning can also help startups present a convincing pitch to potential investors, illustrating how their funds will be used and the expected return on investment.

- Informed Decision-Making: Financial planning provides startups with the data needed to make informed business decisions. This enables them to achieve their financial goals and ultimately create a more sustainable and profitable enterprise.

Strategies for Managing Cash Flow

Managing cash flow effectively is essential for startups, as it enables them to meet their financial obligations and ensure the continued growth of their business. The following strategies can help startups manage their cash flow more effectively:

- Create a Cash Flow Forecast: One of the first steps in managing cash flow is creating a cash flow forecast. This involves predicting the cash inflows and outflows over a specified period, usually 12 months. This forecast enables startups to identify when and where cash shortages may occur, allowing them to make adjustments in their spending and expenses accordingly.

- Invoice Promptly: Ensuring that invoices are sent out promptly and accurately is crucial for maintaining a positive cash flow. Setting up automated invoicing can help streamline this process and ensure that invoices are not delayed or overlooked.

- Offer Incentives for Early Payments: Encouraging customers to pay their invoices early can significantly improve a startup's cash flow. Startups can offer incentives, such as discounts, for customers who pay their invoices before the due date.

- Delay Non-Critical Expenses: To conserve cash, startups should consider delaying non-essential expenses until their financial situation improves. This can include holding off on hiring new staff or expanding office space until the startup has a more stable cash flow.

- Negotiate Better Payment Terms with Suppliers: Startups can work with suppliers to negotiate more favorable payment terms, such as extended payment deadlines or volume discounts. This can help startups free up cash and improve their cash flow situation.

- Maintain a Cash Reserve: Having a cash reserve can help startups weather periods of financial uncertainty and avoid cash flow problems. Startups should aim to maintain a cash reserve equivalent to at least three months of their operating expenses.

- Regularly Review Financial Performance: Startups should regularly review their financial performance to identify areas where improvements can be made. This includes monitoring their cash flow, tracking expenses, and evaluating the effectiveness of their financial strategies. By staying informed about their financial situation, startups can make proactive adjustments to their cash flow management strategies as needed.

Implementing these strategies can help startups effectively manage their cash flow, enabling them to achieve financial stability and focus on growing their business. By staying proactive and strategically planning their finances, startups can avoid common pitfalls and ensure their long-term success.

Budgeting and Financial Forecasting for Startups

Budgeting and financial forecasting are essential components of a well-rounded financial management plan for startups. They offer an organized structure for anticipating and managing financial resources, enabling startups to make informed business decisions that lead to continued growth and success.

Creating a Startup Budget

A startup budget provides a detailed outline of expected costs, expenses, and revenues. It's a critical roadmap that defines how the startup plans to allocate funds and manage finances, based on strategic objectives and growth plans. The key components of a startup budget include:

- Initial costs: These are one-time expenses needed to establish the startup, such as equipment purchases, legal fees, office space, website design, and marketing collateral.

- Fixed monthly expenses: These are recurring costs that occur regardless of the startup's revenue or activity level, such as rent, utilities, insurance, employee salaries, and loan repayments.

- Variable expenses: These costs fluctuate based on business activity, and they include costs like raw materials, shipping fees, and sales commissions.

- Revenue forecasts: Predicted income generated from the sale of products, services, or other income streams, such as royalties, partnerships, and investments.

Creating an accurate and detailed startup budget helps startups track and manage expenses, identify cost-saving opportunities, and measure their financial progress over time.

Financial Forecasting for Startups

Financial forecasting involves projecting future financial performance based on historical financial data, market trends, and business insights. Startups use financial forecasts to:

- Set realistic financial goals that drive growth and profitability.

- Make strategic decisions based on projected revenue, expenses, and cash flow.

- Identify potential financial challenges and develop plans to address them, ensuring long-term financial stability.

- Improve communication with stakeholders, investors, and employees by providing a transparent overview of the company's financial situation.

To develop an effective financial forecast, startups should consider the following steps:

- Review historical financial data: Examine past financial performance to identify patterns and trends that could impact future results.

- Develop assumptions: Make estimates about future market conditions, customer demand, product pricing, and operating expenses based on realistic expectations and research.

- Create financial projections: Use the gathered data and assumptions to build a projected income statement, balance sheet, and cash flow statement that outline expected performance for at least the next 12-24 months.

- Monitor and adjust: Regularly review and update financial forecasts, considering changes in both internal and external factors that might impact the startup's financial performance.

Tools to Help Manage Cash Flow and Finances

As startups grow, managing cash flow and finances can become increasingly complex. Fortunately, there are a wide variety of tools available to simplify and streamline financial management tasks. By using technology, startups can improve efficiency and gain insights into their financial health to make better business decisions. Here are some popular tools to consider:

Accounting Software

Accounting software helps startups automate bookkeeping processes, maintain organized financial records, and comply with tax requirements. Popular options include QuickBooks, Xero, and FreshBooks, which offer user-friendly interfaces, invoice generation, expense tracking, and financial reporting capabilities.

Invoicing and Payment Tools

Processing invoices and receiving payments can be time-consuming for startups. Invoicing and payment tools like Zoho Invoice, Wave, and Square simplify invoice generation and provide secure online payment options for customers, helping startups manage cash flow and minimize the risk of late payments.

Expense Tracking Apps

Expense tracking apps like Expensify, Receipt Bank, and Concur enable startups to scan, categorize, and store expense receipts. This streamlines the expense management process, eliminates the need for manual data entry, and ensures an accurate representation of business expenses, helping startups adhere to their budget.

Cash Flow Management Solutions

Cash flow management tools like Float, Pulse, and CashAnalytics offer startups real-time insights into their cash flow situation, enabling them to identify potential cash shortages or surpluses, manage working capital more effectively, and plan for upcoming expenses.

Budgeting and Forecasting Software

Budgeting and forecasting software like PlanGuru, Prophix, and Adaptive Insights enable startups to develop and manage budgets, create financial forecasts, and analyze financial performance. These tools help startups make data-driven decisions based on projected revenues, expenses, and cash flows.

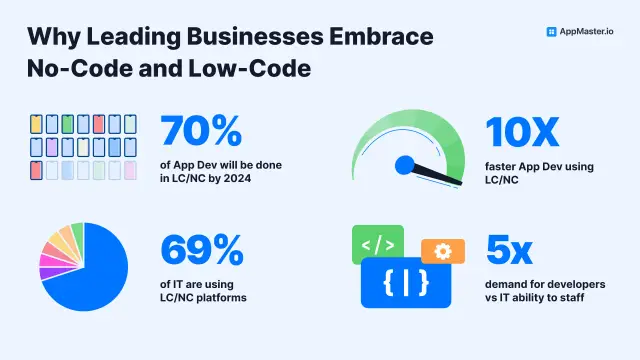

AppMaster for Financial Management in Startups

For startups seeking a more customized approach to financial management, AppMaster's no-code platform presents an excellent opportunity to create tailor-made financial tools. With its visual designer, you can build finance-related apps without writing a single line of code or engaging a development team. Some potential financial management applications you can create using AppMaster include:

- Expense tracking: Develop custom expense tracking tools that record and categorize expenses, helping startups reduce costs and adhere to their budget.

- Automated invoicing: Streamline the invoicing process by creating custom invoicing tools that generate and send invoices, handle reminders, and accept online payments.

- Financial analytics: Gain insights into your startup's financial performance through custom reporting and analytics tools that visualize your cash flow, income, and expenses.

Additionally, using the AppMaster platform ensures you have complete control over the applications you build, allowing you to rapidly update and iterate as your startup's financial management needs evolve.

Managing cash flow and financial planning are essential for startup success. By employing effective budgeting, financial forecasting, and leveraging the power of technology, startups can achieve financial stability, drive growth, and improve their overall financial performance. The AppMaster platform offers a unique solution for startups looking to create custom financial management tools, enabling them to adapt and thrive in the competitive business landscape.

Conclusion

Managing cash flow and financial planning are critical tasks for any startup. A solid financial plan and efficient cash flow management can be the difference between the success and failure of a venture. By implementing effective strategies and leveraging tools that simplify financial operations, startups can mitigate risks, strategically allocate resources, and create a stable financial foundation for sustained growth and success.

Using solutions like the AppMaster no-code platform allows startups to build custom applications tailored to their financial management requirements. By doing so, entrepreneurs can enhance their financial strategies, improve their financial performance, and ultimately grow their businesses with confidence.

FAQ

Financial planning is crucial for startups because it helps them allocate resources effectively, control expenses, predict cash flow needs, mitigate financial risks, attract investors, and make informed financial decisions that can contribute to their continued growth and success.

Strategies for managing cash flow include creating a cash flow forecast, invoicing promptly, offering incentives for early payments, delaying non-critical expenses, negotiating better payment terms with suppliers, maintaining a cash reserve, and regularly reviewing financial performance.

A startup budget should include the initial costs, fixed monthly expenses, variable expenses, and revenue forecasts. This helps startups track and manage expenses, identify cost-saving opportunities, and ensure their finances are on the right track.

Financial forecasting helps startups anticipate future financial performance, set realistic goals, and make better business decisions based on projected revenues, expenses, and cash flows. It also helps them identify potential financial problems and develop strategies to address those issues before they become critical.

Technology tools, such as fintech solutions, can simplify and automate financial management tasks like invoicing, bookkeeping, expense tracking, and cash flow forecasting. This allows startups to streamline their financial processes, improve efficiency, and focus on their core business operations.

AppMaster's no-code platform facilitates the building of custom financial management tools tailored to a startup's unique needs. Startups can develop features like expense tracking, automated invoicing, and financial analytics without writing a single line of code or hiring a development team.