Apple Reinvents Personal Finance: New Savings Account for Apple Card Users

Apple now enables iPhone users with the Apple Card to open a high-yield savings account managed by Goldman Sachs, boasting a 4.15% APY. Seamlessly integrating with Daily Cash rewards, Apple aims to improve users' financial health.

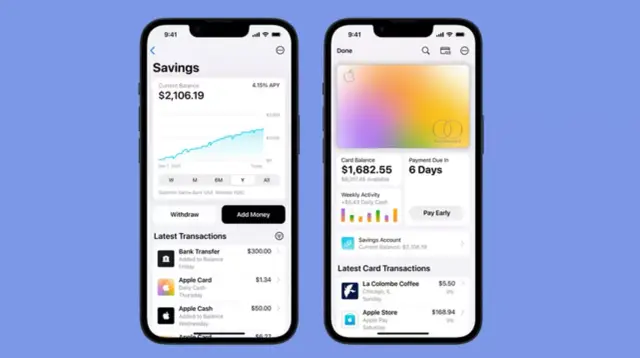

In a bid to further revolutionize the financial world, Apple has now provided its Apple Card users with the ability to open a savings account directly on their iPhones. This feature aims to capitalize on the Daily Cash rewards earned by Apple Card owners by enabling them to deposit these rewards into a high-yield savings account managed by Goldman Sachs.

Initially introduced in October 2022, many speculated that the account's APY (annual percentage yield) would be around 3.75%. To the surprise of many, the actual figure stands at an impressive 4.15%. This is significantly higher than the current national average, making it an attractive proposition for users. However, it's worth noting that this APY is not fixed and may fluctuate over time.

The new savings account operates similarly to a traditional savings account, offering users the benefits of 'no fees, no minimum deposits, [plus] no minimum balance requirements.' The primary advantage, though, is the seamless integration with the Apple Card's Daily Cash rewards. Users will automatically see their Daily Cash earnings deposited into the savings account, with no limit on the amount they can accumulate. It's important to note that the cashback percentages vary depending on the specific merchant, but users will receive up to 3% back on eligible Apple purchases.

Jennifer Bailey, VP of Apple Pay and Apple Wallet, emphasized that Apple's goal is to empower users with the tools necessary to manage their finances more effectively. She cited the example of the Apple Pay Later feature launched in late March, which allows for more flexible payments. To further aid users, the Wallet app will include a dashboard to track account activities, and users can link a personal bank account for seamless deposits and withdrawals.

As for security, Apple assures users that the accounts will be safeguarded with the company's renowned stringent security measures. Additionally, since Goldman Sachs is managing the accounts, user balances are protected by the Federal Deposit Insurance Corporation (FDIC). Users can rest easy knowing that their funds are safe, even in the unlikely event of Apple facing financial difficulties.

However, some limitations exist. Currently, only U.S. residents can open a savings account on their iPhones, as Apple Card availability is limited to the country. Users must also have an iPhone with iOS 16.4 or later. According to the Deposit Account Agreement from Goldman Sachs, accounts have a maximum balance of $250,000. Additionally, bank transfers should be between $1 and $10,000, with a weekly transfer limit of $20,000.

To get started with the new Apple savings account feature, users can follow the step-by-step guide on Apple's Support website. For those interested in no-code app development and exploring more technology solutions, check out the AppMaster platform which simplifies backend, web, and mobile application creation. Learn more about the platform and its offerings by visiting https://appmaster.io/how-to-create-an-app.